This post was originally published in July 2022 and was updated in May 2025, with additional information on understanding invoicing automation, how to automate invoice processing in your organization, and more.

Is your business still printing and mailing paper invoices? If so, you're missing out on some significant benefits of accounts receivable invoice automation.

Regarding the performance of your organization, there’s no doubt that automating your accounts receivable (AR) process is a step in the right direction. Streamlining your AR functions can improve accuracy, reduce the time it takes to collect electronic payments, and enhance customer relationships.

Keep reading to find out more about how AR invoice automation software is an investment that can help you get paid faster and manage your receivables.

Read the blog → Benefits of accounts receivable invoice automation

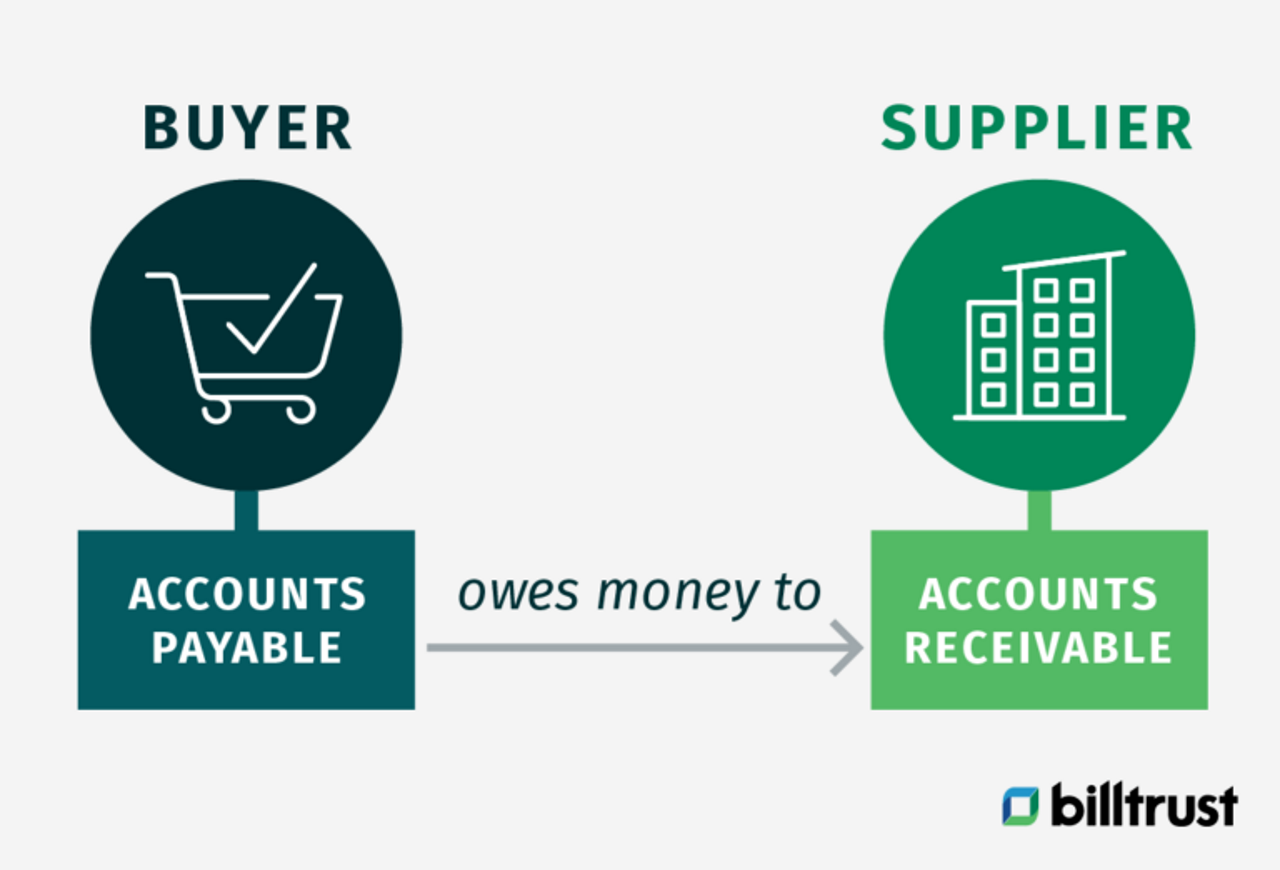

What is accounts receivable?

Accounts receivable (AR) is the total amount of money customers owe a company from sales or services rendered. It's essential to a company's financial statements and cash flow projections. AR management through automated processes helps businesses accelerate payments and improve profitability.

Real results: Material handling equipment dealer transforms AR operations

After implementing Billtrust's invoicing automation solution, Malin achieved:

- 91% electronic invoice presentment

- 78% decrease in invoices with a 90-day overdue status

- 75% reduction in time spent on daily cash application

"Before Billtrust, it took one employee an entire day to post cash, which didn't always post that day. Now it takes under two hours for one person to complete." - Eddy Harless, Finance Manager, Malin

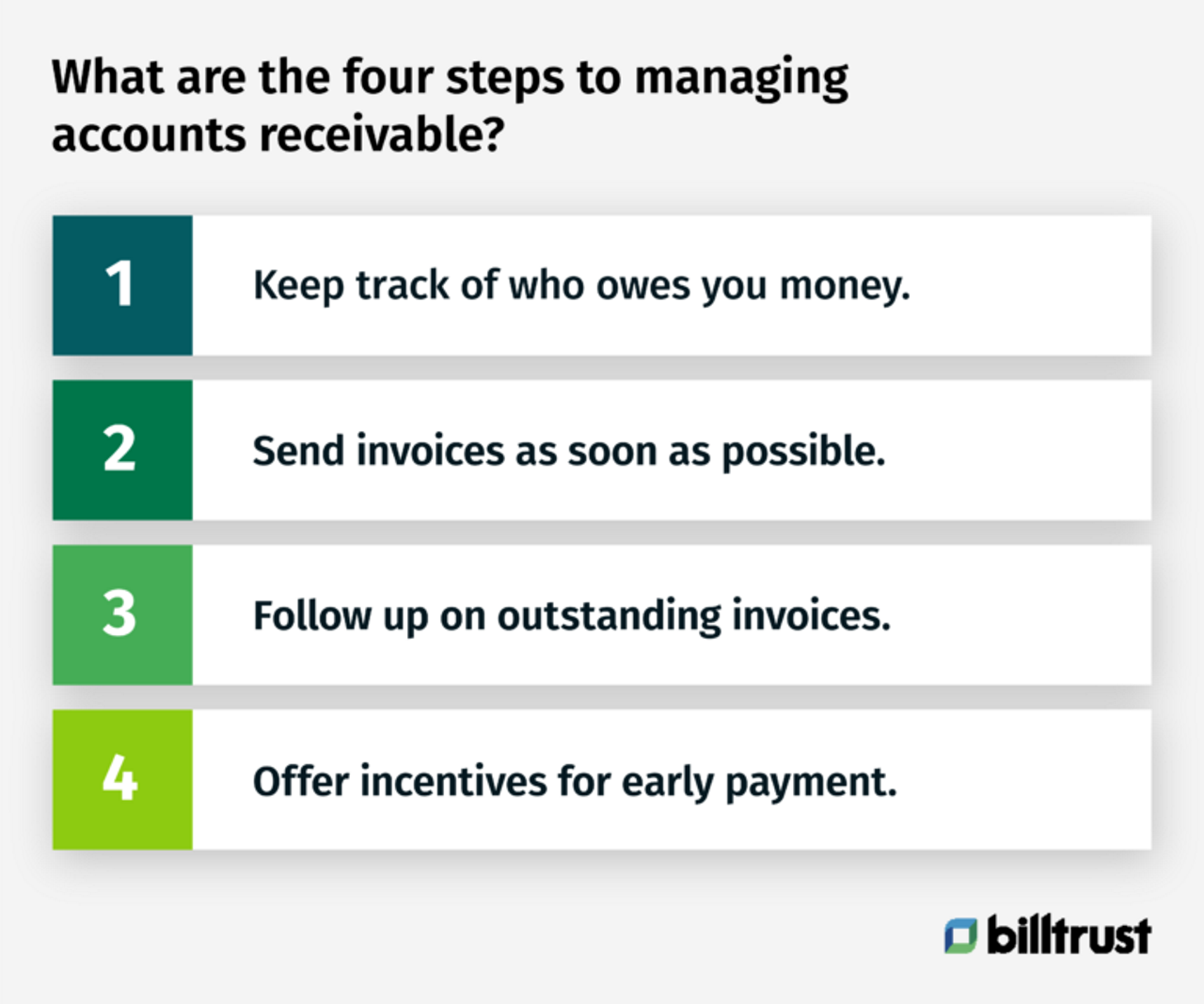

What is the AR billing process?

In any business, cash flow is king. And one of the most significant factors impacting your business's cash is accounts receivable.

Traditionally, businesses have managed their AR manually, which can be time-consuming and error-prone. But with the advent of accounts receivable invoice automation, companies can now manage their AR much more efficiently - with less time and effort.

What is the accounts receivable bill process?

- The first step is to create an invoice using accounting software or a simple spreadsheet.

- When the invoice is created, the customer receives it either electronically or by mail.

- Once the customer receives the invoice, they will have time to pay the bill. A late fee may occur if payment is not received within the specified time frame.

- Finally, once a customer pays their bill, the payment must be recorded in the accounting software.

The AR billing process is integral to running and growing a business, ensuring timely payments and keeping customers current.

See our solution → Billtrust Invoicing: Streamline multi-channel invoice delivery

Understanding automated invoice processing: How modern AR teams streamline their workflow

Invoicing automation revolutionizes how finance teams manage accounts receivable. Automated invoice processing software eliminates manual data entry, transforming traditional invoice handling into a streamlined digital workflow.

Here's how invoicing automation works in practice:

- Advanced artificial intelligence (AI), machine learning, and optical character recognition technology extract invoice data from incoming documents.

- Smart matching algorithms connect invoices with purchase orders and payments.

- Automated validation checks ensure accuracy and compliance.

- Digital delivery systems distribute invoices through your customers' preferred channels.

- Real-time tracking provides visibility into invoice status and payment progress.

- Intelligent payment reminders help accelerate cash flow.

- Automated reconciliation reduces manual matching and posting time.

Invoicing automation is your digital finance team member - one that constantly works to process B2B invoicing, track payments, and maintain accuracy across your entire AR workflow. The system integrates with your existing accounting software, creating a unified platform that grows with your business while eliminating time-consuming manual tasks.

Case study: Heavy equipment dealer maximizes touchless payments

Carter Machinery, a Caterpillar equipment dealer with over 90 years in business, partnered with Billtrust to optimize their invoicing and payment processes. The results were impressive:

- Increased touchless payments from 65% to 84%

- Achieved 76% digital invoicing rate

- Increased ACH from 61% to 82%, shifting payments to more cost-effective methods

This automation allowed them to maintain customer payment choice while significantly reducing processing costs.

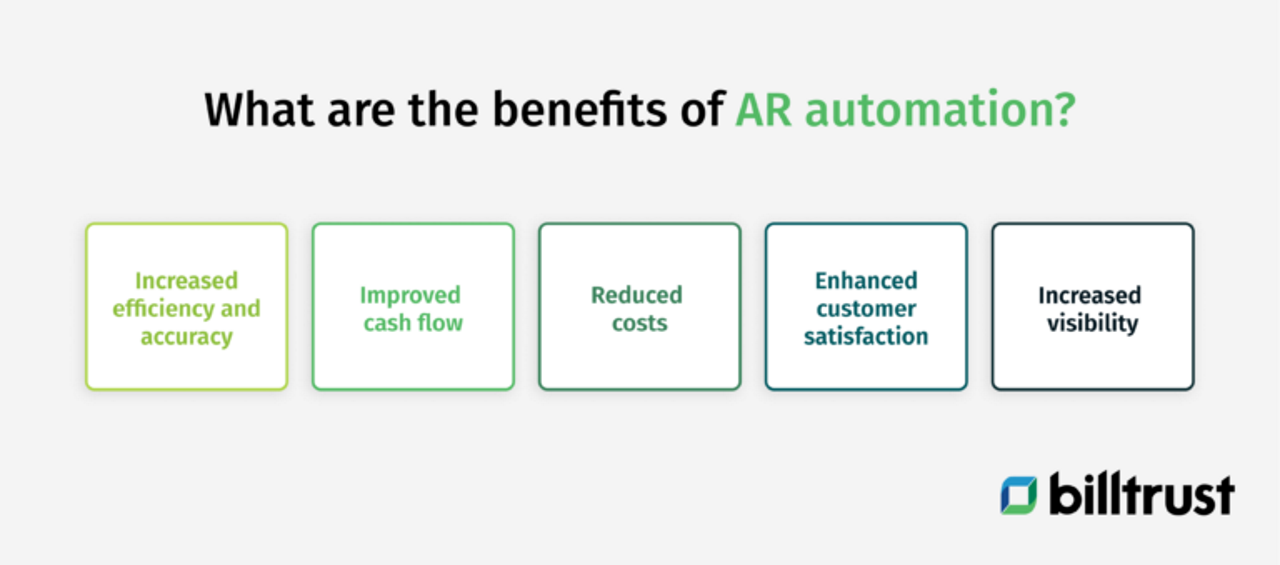

What are the benefits of AR automation?

Accounts receivable e-invoice automation is a game-changer for businesses. Why? Because automated billing and payments can speed up your cash flow. With this technology in place, you can streamline your accounting process, save time and money and improve your bottom line.

Below are five ways that accounts receivable invoice automation software can benefit your business:

1. Increased efficiency and accuracy

Accounts receivable invoice automation can help increase your invoicing process's efficiency and accuracy. This is because the system can automatically generate invoices based on sales data, meaning that there is no need for manual input. Automation can help to reduce errors and save time.

2. Improved cash flow

Optimized cash flow is one of the main benefits of automating your accounts receivable invoicing process. This is because you can send invoices as soon as you make a sale, meaning you are more likely to receive payment shortly. In addition, you can set up automated billing so that customers can make payments immediately after receiving their invoices.

3. Reduced costs

With invoice automation software, there is no need to print and post invoices, and likely fewer errors, meaning that you will save on administrative costs.

4. Enhanced customer satisfaction

Automating your accounts receivable invoicing process can also help enhance customer satisfaction. This is because customers will receive their invoices more quickly, and they will be able to make payments immediately. In addition, automated billing can help reduce the number of customer queries, as all information will show on the invoice.

5. Increased visibility

Finally, automating your accounts receivable invoicing process can also help to increase visibility and control. This is because you can track all invoices and payments using the system, meaning that you can identify any areas of concern quickly and easily.

Success story: Global orthopedics leader enhances AR operations

Össur, a global leader in orthopedic solutions, faced challenges with payment delays and limited data visibility before implementing Billtrust's invoice capture solutions.

After implementation, they experienced:

- Improvements in collections process through real-time updates

- Enhanced customer experience with a user-friendly payment portal

- Streamlined monitoring and boosted operational performance

- Reduced payment lag and improved cash flow

"Billtrust has revolutionized our AR operations. The real-time dashboard and customer portal have transformed how we manage collections and interact with our clients." - Tim Hoffman, VP Americas Finance & Business Operations, Össur

How to automate invoice processing in your organization

Moving to automated invoice processing doesn't have to be complex. Our implementation roadmap ensures a smooth transition while maximizing your ROI:

- Select the right technology partner: Choose an invoicing automation platform that aligns with your business goals and scales with growth. Prioritize solutions offering back-office and Enterprise Resource Planning (ERP) integration, AI capabilities, multiple payment channels, and compliance features.

- Configure your digital environment: Create standardized invoice templates, establish payment terms, and define automated billing workflows. A well-structured foundation ensures consistency while reducing manual intervention.

- Connect your financial ecosystem: Integrate your platform with existing accounting software and ERP systems to create a unified financial environment. This eliminates data silos and provides a single source of truth.

- Establish automated communication flows: Design reminder sequences that respect customer relationships while maintaining consistent follow-up on overdue accounts, balancing OCR automation with personalization.

Implementing invoicing automation is an ongoing commitment. Regular monitoring and optimization ensure your system evolves with your business needs while delivering maximum value to your organization.

Unified financial operations through ERP and API integration

Your invoicing automation solution's value depends on how well it connects with existing systems. Integration with your ERP system and utilization of APIs creates a unified financial environment with significant benefits:

- Data exchange: Ensure financial records remain consistent and updated in real-time across all systems, eliminating data silos that create reconciliation problems.

- Streamlined order-to-cash cycle: Automatically synchronize invoice data with ERPs like SAP, Oracle, and Microsoft Dynamics, reducing manual intervention.

- Customized workflow capabilities: Create direct pathways between your invoice automation software, payment systems, and other applications through API connections.

- Enhanced financial agility: Adapt quickly to changing business requirements while maintaining complete visibility across your financial operations.

This connectivity transforms isolated financial processes into an ecosystem that accelerates cash flow and your accounts receivable function.

AI-powered invoice capture: How automated invoice processing transforms your workflow

Modern accounts receivable demands both speed and accuracy—exactly what the powerful combination of OCR and AI delivers. These technologies revolutionize invoice processing with multiple benefits:

- Elimination of manual processes: Convert paper invoices, PDFs, and digital images into structured, searchable data, transforming static documents into dynamic information assets.

- Intelligent data extraction: Instantly identify and categorize critical data points—invoice numbers, dates, line items, tax amounts, payment terms—routing information to the right systems automatically.

- Continuous improvement: Process invoices with increasing accuracy as machine learning algorithms adapt to your specific invoice formats and vendor patterns.

- Automated verification: Flag unusual charges, discrepancies, or potential duplicate invoices, adding a powerful verification layer to your AR process.

For your finance team, this powerful combination frees resources from data entry and document handling, reduces payment delays from processing errors, and enables greater focus on financial initiatives.

Download the ultimate guide to digital accounts receivable

Reduce manual work with automated invoice capture

Accounts receivable invoice automation is a smart investment for any business that wants to improve efficiency, accuracy and cash management. By automating the process of sending invoices, you can eliminate the need for manual data entry. This can free up your staff to focus on other tasks and also help reduce the chances of errors.

In addition, automating invoicing can help speed up the payment process by providing customers instant access to their invoices. As a result, you can get paid faster and improve your cash flow. Accounts receivable automation can also help you to track payments and keep tabs on customer spending.

Frequently Asked Questions

Check out the FAQs for general questions. Find helpful answers quickly to get the information you need.

Yes, modern invoicing automation platforms are designed to integrate with existing accounting software and ERP systems, creating a unified financial environment that maintains real-time data synchronization.

Automated invoicing accelerates cash flow by sending invoices immediately after sale completion, automating payment reminders, enabling instant electronic payments, and reducing processing delays through automated validation.

Automated invoicing systems include security features to protect sensitive information, such as encrypted data transmission, secure payment processing, role-based access controls, and compliance with financial regulations.