Your customers are the lifeblood of your success. The more satisfied they are, the more likely they will stick around and keep spending money.

But if your customers feel they're being taken advantage of or their concerns aren't being addressed, they may take their business elsewhere.

This is where accounts receivable transparency comes in. By providing precise and concise information about how much money customers owe and when it's due, you can maintain better customer relationships and protect your bottom line.

How can you optimize your customer relationships and revenue through accounts receivable transparency? Read on to find out.

What is AR transparency, and why is it important for customer relations and revenue growth?

AR transparency is a hot topic in the business world right now.

But what exactly is it?

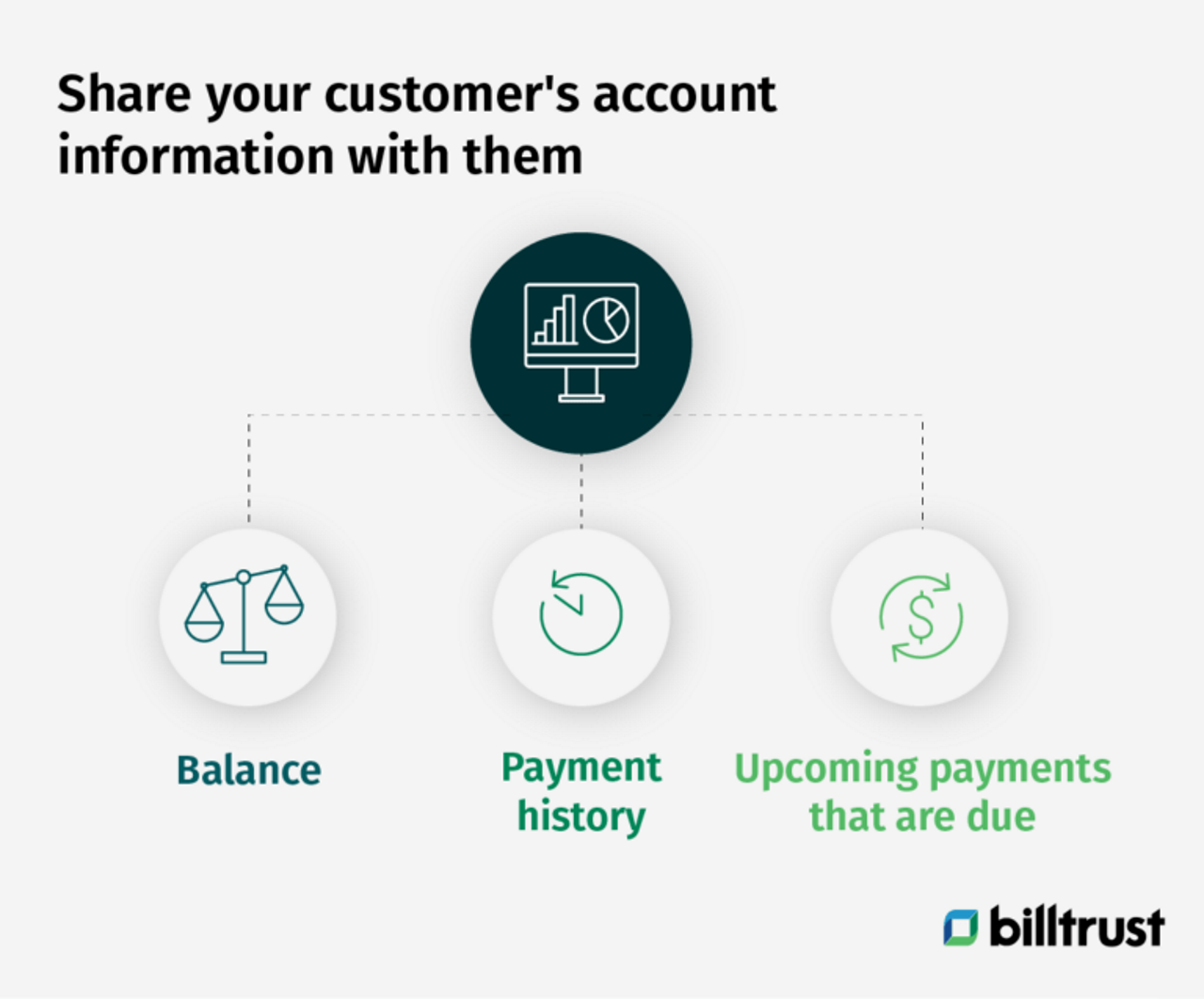

Accounts receivable transparency is sharing information about your customer's accounts with them. This includes things like their balance, payment history and any upcoming payments that are due.

Maintaining AR transparency has many benefits, but the two most important ones are that it helps build customer trust and leads to more revenue. After all, customer experience is more important than ever.

Building trust with customers is essential for any business, but it's critical to the world of accounts receivable. By sharing information about their account, you're showing your customers that you're open and honest about their balance and that they can rely on you to keep them updated. This transparency can go a long way in building customer trust and loyalty.

Accounts receivable transparency also leads to more revenue.

How?

When customers know how much they owe and when it's due, they're more likely to pay their bills on time. And when customers pay their bills on time, it's good for your bottom line.

Does AR transparency impact customer purchase decisions?

Today, more and more businesses are tuning into accounts receivable transparency and for a good reason. Customers are increasingly interested in knowing where their money is going and want to ensure that businesses handle their finances responsibly. As a result, many companies are now making an effort to be more transparent about their accounts receivable policies.

Part of good customer relationship management is being transparent about accounts receivable. When customers know how much money they owe to the business, they are more likely to trust it and make purchases. Furthermore, being transparent about accounts receivable can help companies to build customer loyalty.

Also, customers with access to information about a company's accounts receivable policy are more likely to trust that company. They know that the company is being open and honest about its finances, and this can make them more likely to do business with that company.

Additionally, transparency can help build strong customer relationships. For example, when customers feel like they understand a company's financial situation, they are more likely to be loyal to that company.

Finally, transparency can also lead to better customer service. For example, if customers know how a company's accounts receivable process works, they are less likely to experience problems or delays.

In short, accounts receivable transparency is good for business. When customers feel they can trust a company, they are more likely to continue doing business with it.

Before you decide to outsource bookkeeping, be sure to weigh the advantages and disadvantages. Consider your needs and budget, and make the best decision for your business.

How to be transparent with customers about accounts receivable

Maintaining healthy customer relationships is one of the most important aspects of running a business, and much of this involves being transparent about your accounts receivable policy.

Why?

Customers need to know when they need to pay and how you plan to collect outstanding payments. If you're upfront with customers about your expectations, they're more likely to trust you and do business with you in the future.

So how can you be more transparent with your customers about accounts receivable?

Here are a few tips to improve your AR transparency:

- Regularly communicate with your customers about their outstanding payments. You can do this through monthly statements or invoices.

- Make it easy for customers to pay their invoices by offering multiple payment options such as online banking, debit/credit cards or installment plans.

- Be flexible regarding payment deadlines, and offer discounts for early payments. This shows that you're willing to work with your customers to find a solution that works for both parties.

- Keep late fees to a minimum, as this can deter customers from doing business with you in the future.

- Consider offering a rewards program for customers who consistently pay on time. This could be simple as giving them a discount on their next purchase.

Following these tips can build trust and transparency with your customers around the accounts receivable issue. This will help you solidify customer relationships and keep your business running smoothly.

Download the ultimate guide to digital accounts receivable

How to use data gathered through AR transparency to improve customer retention rates and boost revenue growth

Data is a powerful tool, and when it comes to customer relationships there is no such thing as too much information. The more you know about your customers, the better you can serve them and keep them returning for more.

Accounts receivable transparency is one way of gathering customer data, and you can use it to improve customer retention rates and boost revenue growth.

You can better understand customer spending patterns and preferences by tracking customer payments. You can then use this information to tailor your product offerings and marketing campaigns to meet their needs better.

By understanding how customers interact with invoices and payments, you can take steps to improve customer retention rates. For example, if customer data shows that invoices are often unpaid or late, companies can take steps to streamline the invoicing process or offer discounts for early payments.

Additionally, you can identify areas where you can improve customer service by analyzing customer data. This could involve reducing phone wait times to offer more flexible payment options.

In addition, by staying on top of customer payments, you can quickly identify any red flags that may indicate a customer is at risk of leaving. This allows you to take action to retain the customer before they go.

The bottom line?

Customer data is a valuable asset, and by leveraging the power of AR transparency, you can use it to improve customer retention rates and boost revenue growth.

The future of AR transparency and its impact on customer relationships and revenue growth

Maintaining customer relationships is essential for driving revenue growth; staying up-to-date on the latest trends and technologies that can impact customer relationships is crucial.

One such trend is accounts receivable (AR) transparency. In recent years, there has been a shift towards greater openness in accounts receivable, and this trend will likely continue.

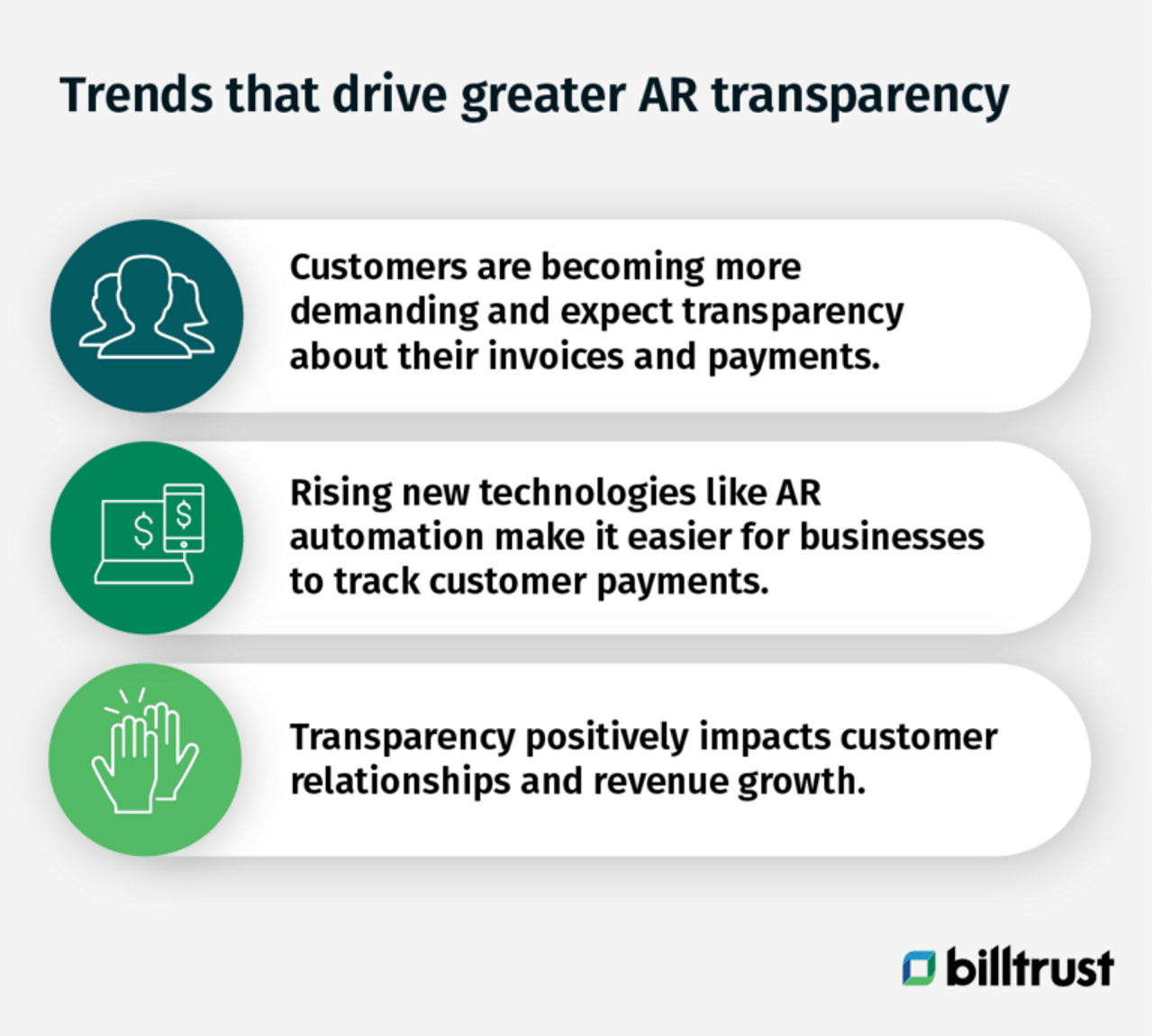

There are several reasons for this shift:

- First, customers are becoming more demanding and expect businesses to be transparent about their invoices and payments.

- Second, the rise of new technologies has made it easier for businesses to track customer payments and provide transparency around the issue of accounts receivable.

- Third, increased transparency around accounts receivable is having a positive impact on customer relationships and revenue growth.

As more businesses adopt AR transparency, it will become increasingly crucial for you to use this data to improve customer relationships and drive revenue growth.

Why?

You can build trust and foster better communication by giving customers visibility into their invoices and payment status. This can lead to improved customer retention rates and increased sales.

In addition, transparent accounts receivable can help you identify issues early on and take corrective action before they impact your bottom line.

Strengthen customer relationships with automated accounts receivable (AR)

Accounts receivable transparency is a powerful tool that you can use to improve customer relationships and boost revenue growth. You can build trust and foster better communication by giving customers visibility into their invoices and payment status. This can lead to improved customer retention rates and increased sales.

As transparency in accounts receivable becomes the norm, companies that embrace this trend will be well positioned to drive growth and build lasting customer relationships. It’s one of the reasons why most companies are implementing accounts receivable automation solutions.