The electrical distribution industry is undergoing a transformation

Inflation-fueled price increases, technological developments, and a historic rise in mergers and acquisitions have created tremendous opportunity.

With ongoing supply chain issues and labor shortages, inventory management is now more important than ever. Managing inventory manually is no longer sustainable for electrical distributors, and shifting towards an online eCommerce platform is becoming essential. While many buyers still purchase products in-person or over the phone, an ever-growing number areadopting eCommerce as the primary way to shop for electrical equipment.

In addition, with an increasing volume of payments arriving in various forms, many businesses are encumbered by outdated accounts receivable processes. Growth is good for business, but the complete order-to-cash processes (including AR) need to scale too. Delayed payments, poor inventory management, and credit card fees can become very costly and time consuming. Businesses must find ways to optimize these processes if they wish to stay competitive.

A significant portion of electrical distribution companies are still managing their invoice-to-cash processes manually or through their own in-house systems. But they are struggling to have reliable, effective, automated accounts receivable (AR) processes that will allow their business to save time and optimize cash flow.

The rise of accounts payable (AP) portal adoption has also made getting paid more complicated for electrical distribution companies. AR teams need to maintain login credentials to dozens of portals, follow complex invoicing rules for each customer, then return to those portals again and again to check on payment statuses and download remittances. This process is complicated, tedious, and adds unnecessary frustration to AR teams.

More and more buyers in the electrical distribution industry are using credit cards. This allows them to hold their money longer and receive benefits. However, in order to accept credit card payments the seller must pay a 3% fee. The more business a company does, the more these fees add up. By implementing surcharging, companies can entirely offset these unnecessary expenses.

Your customers need solutions that make it easier to do business with you by offering an online portal to access invoices and make payments as they prefer (ACH or credit card) — with 24/7 convenience.

The goal? Give them an utterly simple online experience to place orders and manage payments that gives your customers the flexibility to find, order, and pay for what they need when they need it.

Billtrust works with over 160 electrical companies supporting the unique industry needs, including:

- Consumer Electronics

- Commercial Facilities

- Cable & Wire

- Wholesalers

- Retailers

Scale your online business and get paid faster

Scale your online business and get paid faster. Accelerate online revenue growth, scale seamlessly and optimize your customer experience with an intelligent B2B/B2C web store platform and touchless invoicing and payment solution.

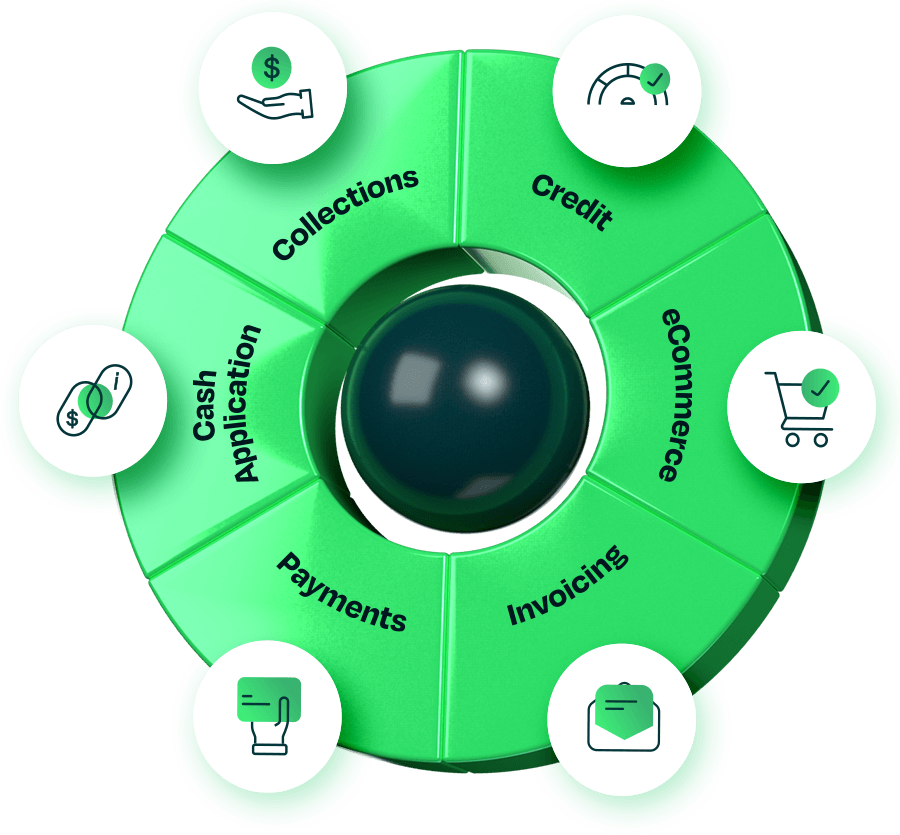

Credit

Billtrust Credit Application allows you to create online, custom credit applications to safely store and centralize sensitive credit information, make faster and more efficient credit decisions, and keep relevant teams informed.

eCommerce

Jumpstart B2B and B2C online ordering with an automated order-to-cash solution that offers an exceptional customer experience. With Billtrust eCommerce, you get a highly configurable webstore platform and digital strategies — or turnkey solutions — that handle unlimited SKUs and integrate with most ERPs.

Invoicing

Billtrust Invoicing streamlines and automates multi-channel invoice delivery, locally and around the world. You can cut and control operating costs while simplifying invoice presentment and giving your customers the invoicing flexibility and efficiency they need.

Payments

Billtrust Payments allows suppliers to facilitate accelerated, predictable payments on their terms while offering flexibility to all customer segments. Your customers benefit from a convenient B2B payment experience on a fully-brandable portal, while giving you the ability to accept payments through your preferred channels.

Business Payments Network

Billtrust’s Business Payments Network (BPN) connects order-to-cash functionality with the rest of the B2B payments ecosystem. BPN allows you to optimize both sides of the transaction by delivering invoices to AP portals your customers use and automatically capturing and processing their payments.

Cash Application

Billtrust Cash Application handles payments swiftly by turning an unnecessarily complicated process into a manageable one through automation and machine learning. As a result, you benefit from a radical improvement in match rates across all payment channels, streamlined exception handling and achieve industry-leading straight-through processing.

Collections

Billtrust Collections optimizes collections processes by surfacing customers who need outreach most, automating repetitive tasks, providing AI predictive insights to forecast cash and optimize collections steps, and personalizing customer outreach to ensure a positive customer experience.

Professional & Customer Services

With the help of our experts you’ll accelerate time-to-value with a proven AR implementation program. Our professional services organization has identified the critical steps your business should take at each stage, from purchase to post-launch performance and beyond. Our proven blueprint sets you up for customer success and assists you in becoming an expert on your own.

Challenges we solve for building supply companies

- Reduce time and cost of invoice delivery, regardless of customer expectations and shifting timelines.

- Adapt to varying customer payment methods including virtual credit card payments.

- Make smart choices regarding surcharging to reduce the cost of customers making credit card payments.

- Increase accuracy and shorten time to apply cash resulting in reduced labor costs and reduced bank costs.

- Outdated, manual collections causes issues such as aging invoices, possible service interruptions, bad debt, and increased write-offs.

- Provide a seamless customer experience to place orders, access invoices and make payments efficiently online.