The distribution business is hard enough.

Supply chain disruptions, inflation and unpredictable demand all conspire to slow cash flow across the distribution industry. And cash flow is king. You need to protect your ability to build inventory, meet expenses and deliver goods and services for your customers.

The order-to-cash process is fertile ground for improving cash flow – though it’s not at the top of most distributors' list of priorities.

But we hope to convince you in this solution guide that order-to-cash is exactly where you should be putting your energy, your investments and your hopes for a big boost to your financial fortunes.

Automated accounts receivable software solutions offered by Billtrust reduce manual processes, increase accuracy and allow you to deliver a better billing and payment experience to your customers.

In effect, they do more than improve your cash flow – they improve your business.

Gain flexibility

Billtrust’s powerful financial tools enable distributors to exert more influence over how and when customers pay. Divide your customers into buyer groups with unique payment acceptance criteria. Develop and automatically enforce early payment incentives. And use these new powers to influence cash flow so you can weather the uncertainty of the marketplace.

Gain visibility

Personalize your invoices and invoice into the ideal channel for each of your customers. Automate payment reminders and use intelligent collecting tools that get the right customers' attention at the right time.

Gain authority

When you automate your AR processes with Billtrust, you reduce manual tasks for your team and the errors that come with them. You embrace better invoicing practices that give your customers the knowledge and tools they need to pay you sooner. And you unlock advanced analytics and reporting that inform decision-making.

We serve over 440 distribution companies

Billtrust is well-versed in the needs of distributors across the industry. Our experience is broad and deep, serving small-to-medium sized companies and global leaders alike.

We work with companies distributing:

Billtrust drives digital payments and accelerates cash flow through automation, machine learning and robotic process automation (RPA).

Your goods arrive at the right place and time. Now your invoices and payments will, too.

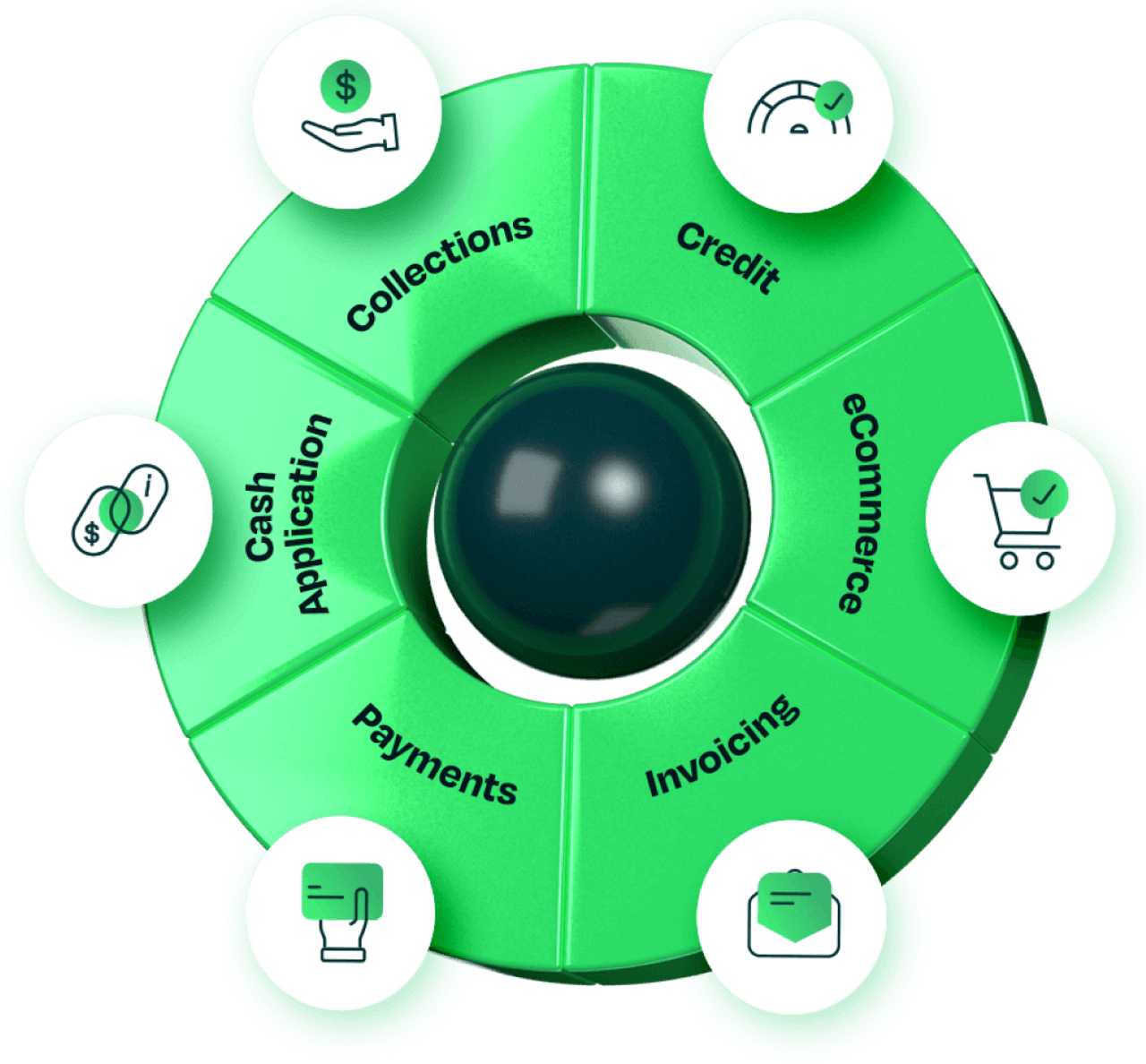

Credit

Billtrust Credit Application allows you to create online, custom credit applications to safely store and centralize sensitive credit information, make faster and more efficient credit decisions, and keep relevant teams informed.

eCommerce

Billtrust eCommerce gives your customers a better ordering experience with turnkey (but highly configurable) webstores. Your sales team will use it as a powerful inventory and product information tool. And you will gain access to accelerated digital marketing. Customers will love your new mobile app and our AI-powered product recommendation engine.

Invoicing

Billtrust Invoicing streamlines and automates multi-channel invoice delivery, locally and around the world. You can cut and control operating costs while simplifying invoice presentment and giving your customers the invoicing flexibility and efficiency they need.

Payments

Billtrust Payments allows suppliers to facilitate payments on their terms while offering flexibility to all customer segments. Your customers benefit from a convenient B2B payment experience on a fully-brandable portal. And you’ll be able to cost-effectively accept payments through your preferred channels.

Cash Application

Billtrust Cash Application transforms a complicated process into a manageable one through automation and artificial intelligence. You’ll benefit from a radical improvement in match rates across all payment channels, streamlined exception handling and straight-through processing.

Collections

Billtrust Collections optimizes collections processes by surfacing the customers who need outreach most, automating repetitive tasks and providing predictive AI-insights into cash forecasting. Your collectors will also find that it’s easier to optimize their activities and personalize their customer outreach.

Professional & Customer Services

With the help of our experts you’ll accelerate time-to-value with a proven AR implementation program. Our professional services organization has identified the critical steps your business should take at each stage, from purchase to postlaunch performance and beyond. Our proven blueprint sets you up for customer success and assists you in becoming an expert on your own.

Benefits we deliver for distributors

Reduced time and cost of invoice delivery, regardless of external factors.

Easy adaptation to varying customer payment methods including virtual credit card payments.

Reduced cost and complexity of customers making credit card payments by using level 2 / 3 processing to lower fees and surcharging to recover costs.

Increased accuracy and shortened time to apply cash resulting in reduced labor costs and faster cash flow.

Better collections outcomes like lower DSO, better customer relationships, and reduced write-offs.

Protection from future disputes by quickly resolving discrepancies that would lead to late payments.

A seamless customer experience for order placement, invoice access and online payments.

Download the Distribution Solution Guide

Learn how you can conquer cash flow challenges for your distribution business with this solution guide.