Efficient invoicing is more than just a back-office function—it's a critical component of your company's financial health and customer relationships. Efficient invoicing directly impacts your cash flow, customer satisfaction, and operational efficiency. With the right software, you can streamline processes, reduce errors, and get paid faster. But with so many options available, how do you determine which solution is the best fit for your organization? This guide will explore the features, comparisons, and insights you need to make an informed decision for your business.

How software improves invoicing

Invoicing software is an indispensable tool for businesses of all sizes, revolutionizing the way companies manage their accounts receivable processes. The right invoicing software can transform your financial operations, streamlining workflows and enhancing the efficiency of your business. Let's examine how invoicing software can significantly improve your accounts receivable processes and contribute to stronger financial health.

- Automation: Software eliminates manual data entry, reducing errors and saving time.

- Consistency: Standardized templates ensure professional, branded invoices every time.

- Speed: Automated systems can generate and send invoices instantly, accelerating cash flow.

- Tracking: Real-time visibility into invoice status helps manage outstanding payments.

- Integration: Connection with other financial systems for a holistic view of your finances.

- Compliance: Automated systems and e-invoicing help ensure adherence to tax regulations, global mandates and industry standards.

- Customer experience: Self-service portals and multiple payment options improve customer satisfaction.

Read the blog → E-invoicing and compliance updates June 2024

Features to look for in invoicing software

When evaluating which software is best for invoicing, consider a range of features that can impact your business operations. The right combination of features can streamline your invoicing process, improve cash flow, and enhance customer relationships. From customization options to integration capabilities, each feature plays a vital role in creating an efficient and effective invoicing system. Let's explore the key features you should consider when choosing invoicing software.

- Customizable templates: Ability to create professional, branded invoices.

- Automated recurring invoices: Set up regular billing cycles for repeat customers.

- Multi-currency and multi-language support: Essential for global businesses.

- Payment integration: Accept various payment methods directly through invoices.

- Late payment reminders: Automated follow-ups for overdue invoices.

- Reporting and analytics: Insights into payment trends and cash flow.

- Cloud-based access: Work from anywhere, anytime.

- Mobile functionality: Create and send invoices on-the-go.

- API integrations: Connect with other business systems (ERP, CRM, etc.).

- Compliance features: Ensure invoices meet legal, regulatory and tax requirements.

Common invoicing challenges solved

Even the most efficient finance teams face obstacles in their invoicing processes. Understanding these challenges—and how modern invoicing software solutions address them—is crucial for improving your accounts receivable operations. Let's explore common B2B invoicing pain points and their solutions.

Manual data entry issues

Manual data entry isn't just time-consuming—it's a risk to business. Common problems include:

- Transcription errors leading to payment delays.

- Hours spent on repetitive data input.

- Inconsistent invoice formatting.

- Delayed invoice processing.

- Staff time wasted on low-value tasks.

AI-powered automation eliminates manual entry through intelligent data capture and reduce errors while accelerating invoice processing times. Billtrust's automated system can process thousands of invoices daily with consistent accuracy and formatting.

Payment reconciliation problems

Matching payments to invoices becomes increasingly complex as your business grows:

- Decoupled remittances from multiple sources.

- Partial payments creating confusion.

- Missing or incorrect payment references.

- Time-consuming exception handling.

- Limited visibility into payment status.

Advanced machine learning algorithms automatically match payments to invoices, even with incomplete information. Our cash application solution delivers industry-leading match rates, dramatically reducing the time spent on manual reconciliation.

International billing complexities

Global business brings additional challenges:

- Multiple currency requirements.

- Different tax regulations by country.

- Varying invoice format requirements.

- Language barriers.

- Time zone considerations.

Built-in multi-currency and multi-language support ensures compliance with local requirements while maintaining efficiency. Our platform automatically handles currency conversions, tax calculations, and format requirements for different regions.

Compliance challenges

Staying compliant with evolving regulations is increasingly complex:

- Changing e-invoicing mandates.

- Tax requirement variations.

- Industry-specific regulations.

- Audit trail requirements.

- Data protection rules.

Our continuously updated compliance engine ensures invoices meet the latest requirements across regions and industries. Built-in validation checks and audit trails help maintain compliance while reducing risk.

Customer communication issues

Poor invoice communication leads to payment delays:

- Limited visibility into invoice status.

- Difficulty accessing invoice history.

- Multiple communication channels.

- Invoice delivery preferences.

- Dispute resolution delays.

Self-service customer portals provide access to invoice history and payment options. Our platform enables multi-channel delivery based on customer preferences, while automated reminders and updates keep everyone informed.

Why Billtrust is the best

In the competitive world of invoicing software, Billtrust distinguishes itself as a cut above the rest, offering a solution that addresses the complex needs of modern businesses. Its combination of advanced technology, industry expertise, and customer-centric approach sets it apart from other options in the market. Let's delve into the key factors that make Billtrust the superior choice for businesses seeking to optimize their invoicing processes.

- End-to-end solution: Billtrust offers a unified platform covering the entire order-to-cash cycle, not just invoicing.

- AI-powered automation: Advanced machine learning algorithms optimize processes and reduce manual work.

- Scalability: Suitable for mid-market to enterprise-level businesses, growing with your needs.

- Industry expertise: Deep knowledge of industries ensures tailored solutions.

- Global capabilities: Multi-currency, multi-language support, and compliance with international e-invoicing regulations.

- Integration prowess: System that integrates with existing financial software.

- Customer-centric approach: Focused on improving not just your processes, but your customers' experience too.

- Proven track record: Over 20 years of experience, serving 2,400+ customers worldwide.

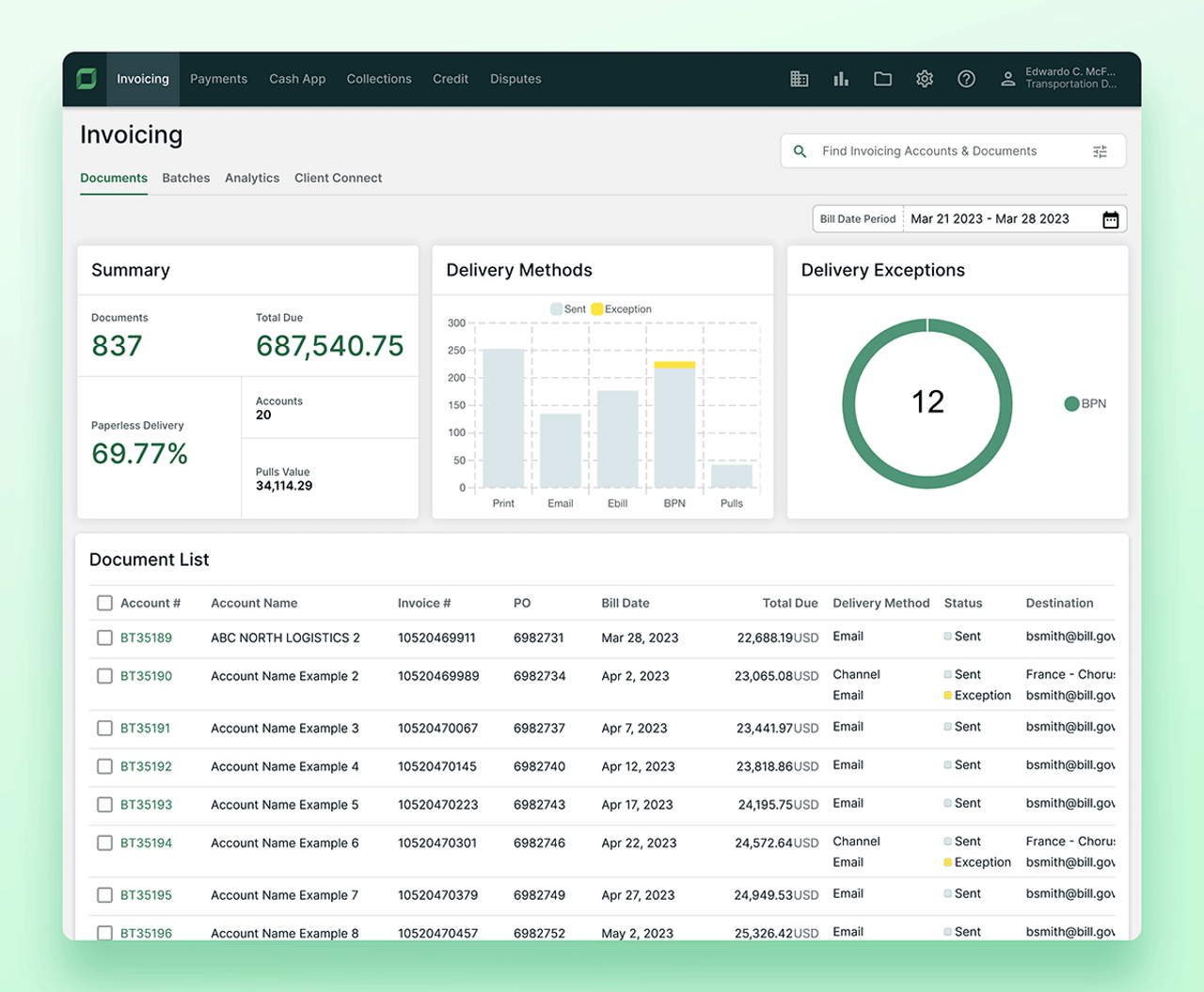

What's included in Billtrust's Invoicing software

Billtrust's Invoicing solution is a powerful, feature-rich platform designed to meet the needs of businesses across industries. Going far beyond basic invoicing functionality, it offers a suite of tools and capabilities that can transform your accounts receivable process. Let's explore the key components that make Billtrust's invoicing software stand out.

- Automated invoice creation and delivery: Streamline the entire invoicing process.

- Electronic invoicing support: Meet the growing demand for paperless transactions.

- Compliance management: Stay up-to-date with various e-invoicing regulations.

- AP portal processing: Simplify invoice submission to customer portals.

- Multi-channel delivery: Send invoices via email, print, fax, or EDI based on customer preferences.

- Self-service customer portal: Empower customers to access and pay invoices online.

- Detailed analytics: Gain insights into invoice performance and payment trends.

- Integration with cash application solutions: For a straightforward order-to-cash process.

Industry specific invoicing needs

Different industries face unique challenges and requirements in invoicing processes, necessitating tailored solutions. Understanding these industry-specific needs is important when evaluating which software is best for invoicing in your field.

- Manufacturing: Needs to handle complex pricing structures and volume discounts.

- Healthcare: Requires compliance with HIPAA and other regulations.

- Construction: Needs progress billing and change order management.

- Professional services: Requires time-tracking and project-based billing.

- E-commerce: Needs integration with online platforms and marketplaces.

The role of AI and automation in modern invoicing

Artificial Intelligence (AI) and automation are no longer futuristic concepts but present-day necessities in the world of invoicing. These technologies are transforming traditional invoicing processes, bringing unprecedented levels of efficiency, accuracy, and insight. As we explore the role of these technologies, it's clear why they are increasingly essential in determining which software is best for invoicing in today's fast-paced business environment.

- Intelligent data capture: AI can extract relevant information from various documents, reducing manual data entry.

- Predictive analytics: Forecast payment behavior and optimize collection strategies.

- Automated matching: AI algorithms can accurately match payments to invoices.

- Smart notifications: AI can determine the best time and method to send reminders for optimal results.

- Fraud detection: AI can identify unusual patterns that may indicate fraudulent activity.

Integration capabilities why they matter

Integration is necessary for maintaining operational efficiency and data consistency across your organization. When considering which software is best for invoicing, understanding the importance of integration capabilities can distinguish between a solution that simply works and one that truly transforms your financial processes.

- Data consistency: Ensure all systems have the most up-to-date information.

- Efficiency: Eliminate duplicate data entry and reduce manual processes.

- Holistic view: Get a complete picture of your financial health across all systems.

- Improved decision making: Access to data leads to better strategic choices.

- Customer experience: Integration allows for a smooth experience across all touchpoints.

Compliance and security considerations

The right solution must streamline your financial processes and ensure that your transactions are secure and compliant with relevant laws and standards. When evaluating which software is best for invoicing, it's important to understand how different solutions address these critical aspects of modern business operations.

- Data protection: Ensure your invoicing software complies with data protection regulations like GDPR.

- E-invoicing regulations: Stay compliant with evolving e-invoicing laws in different countries.

- Tax compliance: Automatically calculate and apply the correct tax rates.

- Audit trails: Maintain detailed records for auditing purposes.

- Secure payment processing: Ensure all payment transactions are encrypted and secure.

Cost analysis pricing models and ROI

While features and functionality are crucial, the financial aspect of implementing new invoicing software cannot be overlooked. Understanding different pricing models and calculating potential return on investment (ROI) help determine which software is best for invoicing in your organization. Let's explore these options and consider the factors contributing to a positive ROI, helping you make an informed decision that aligns with your budget and business goals.

- Subscription-based: Monthly or annual fees based on features or number of users.

- Transaction-based: Fees charged per invoice or transaction processed.

- Tiered pricing: Different levels of service at varying price points.

- Custom enterprise pricing: Tailored solutions for large businesses with complex needs.

While Billtrust's pricing is customized based on business needs, it's important to consider the return on investment (ROI). Factors to consider in ROI calculations include:

- Time saved: Automation reduces manual work hours.

- Faster payments: Improved cash flow through quicker invoice processing and payment.

- Reduced errors: Fewer mistakes mean less time spent on corrections and disputes.

- Scalability: Ability to handle increased invoice volume without proportional cost increases.

- Customer satisfaction: Improved experience can lead to better business relationships and retention.

User experience and customer support

The success of any software implementation largely depends on how easily your team can adopt and effectively use the new system. User experience and customer support play pivotal roles in ensuring a smooth transition and ongoing satisfaction with your invoicing software. When considering which software is best for invoicing, look beyond just features and consider how your team will receive the solution and the level of support you can expect from the provider.

- User interface: Clean, modern design that's easy to navigate.

- Onboarding process: Smooth implementation and training for your team.

- Customer support channels: Multiple ways to get help (phone, email, chat).

- Knowledge base: Comprehensive self-help resources and documentation.

- Ongoing training: Regular webinars or tutorials on new features and best practices.

How to choose the right invoicing software for your business

Selecting the right invoicing software can impact your business's financial operations and efficiency. With numerous options available, each offering unique features and benefits, the choice can seem overwhelming. However, by following a structured approach and considering key factors, you can navigate this decision-making process effectively. Let's explore a step-by-step guide to help you determine which software is best for invoicing in your specific business context.

- Assess your needs: Understand your current processes and pain points.

- Define your goals: What do you want to achieve with new invoicing software?

- Consider scalability: Will the software grow with your business?

- Evaluate integration capabilities: How well will it work with your existing systems?

- Check compliance features: Ensure it meets your industry and regional requirements.

- Review user experience: Is it intuitive for your team to use?

- Analyze costs and ROI: Understand the total cost of ownership and potential returns.

- Read reviews and case studies: Learn from others' experiences.

- Request demos: Get hands-on experience with your top choices.

- Consult your team: Involve key stakeholders in the decision-making process.

Choosing the right invoicing software is a critical decision that can impact your business's financial health and operational efficiency. While there are many options available, Billtrust stands out as a comprehensive, AI-powered solution that can meet the complex needs of modern businesses. Its end-to-end approach to the order-to-cash cycle, coupled with industry-specific expertise and a focus on customer success, makes it a top choice for businesses looking to optimize their invoicing processes.

Billtrust Your partner in financial innovation

At Billtrust, we're on a mission to revolutionize the order-to-cash process for businesses worldwide. As the leading provider of accounts receivable automation solutions, we've spent over two decades helping our customers gain efficiencies, grow revenue, and increase profitability.

What sets us apart is our focus on our customers' success. We believe in listening actively to our clients' needs and tailoring our solutions to meet the unique challenges of each industry we serve. Our team of experts brings deep industry knowledge and a passion for problem-solving to every engagement.

At Billtrust, we're more than just a software provider – we're your partner in financial success. We're committed to helping you control costs, accelerate cash flow, and improve customer satisfaction. With Billtrust, you're not just keeping up with the future of accounts receivable – you're leading the way.

Join us in moving finance forward. Because with Billtrust, you can do anything.

Frequently Asked Questions

Check out the FAQs for general questions. Find helpful answers quickly to get the information you need.

Many invoicing solutions, including Billtrust, offer integration capabilities with popular accounting and ERP systems.

ROI varies but often includes time savings, faster payments, reduced errors, and improved cash flow. Billtrust customers have reported significant improvements in these areas.

It's good practice to review your invoicing processes and software annually to ensure they're still meeting your evolving business needs.