In the dynamic business landscape of 2024, the view from the finance leader's or business owner's window reveals an economy demanding efficiency and accuracy in managing revenue cycles.

With the plethora of accounts receivable software available, they must sift through offerings to ensure they select a tool that fits not only their current needs but also scales with their future growth.

The difficulty lies not in the lack of options, but in navigating the seas of jargon and the multitude of feature sets to find a solution that stands out. This guide will map the route to choosing the perfect accounts receivable software, providing a detailed compass for finance leaders and business owners navigating these decisions.

What's new?

In 2024, the landscape of accounts receivable software has evolved significantly, impacted by technological advancements and changing market demands. One of the most notable changes is the integration of artificial intelligence (AI) and machine learning algorithms, which have greatly enhanced the efficiency and accuracy of financial transactions and record-keeping.

These technologies have enabled predictive analytics, allowing businesses to forecast cash flows more accurately and identify potential risks earlier. Additionally, there's been a shift towards cloud-based solutions, offering greater flexibility and accessibility for businesses operating remotely or across multiple locations.

The emphasis on improved user experience has also led to more intuitive interfaces and streamlined processes, reducing the learning curve for new users and increasing overall productivity. Furthermore, enhanced security features address growing concerns over data breaches and financial fraud, ensuring that sensitive financial information is protected with the latest encryption technologies.

The necessity of a clear vision

Choosing the best accounts receivable software starts with visualizing the outcome you desire. Do you aim to streamline invoicing processes to achieve faster collections? Or, does your focus lie in building a customer portal for easy payment tracking? Clear business objectives steer you towards specific features within accounts receivable software that align with these goals.

The language of your goals

Before you start exploring software, define and translate your goals into the language of software features. Are you after predictive analytics for smarter collections, or is invoice tracking leading your pack? Perhaps it's improved payment processing and the ability to offer customer discounts that are on your roadmap. Once you're fluent in the dialect of features, it's time to move to the next stage.

Feature mapping

List your desired features in priority order. Consider both your immediate objectives and future requirements. This map of features acts as your guide in comparing the different software solutions you'll encounter. It ensures that you don't get swept away by flashy but ultimately unnecessary add-ons.

Researching accounts receivable software

With your feature map in hand, it's time to dig deep into the world of accounts receivable software. The vastness of the market can be overwhelming, so careful research is essential. Look for software that integrates seamlessly with your existing systems, is adaptable to your industry's regulatory environment, and is known for reliable customer support.

Key features to look for

Accounts receivable software, at a minimum, should provide tools for invoice processing and tracking, payment processing, and a customer portal. However, it is the advanced features that will set certain platforms apart. Look for automation capabilities, customizable reporting and analytics, and the ability to easily integrate with other financial tools in your arsenal.

Understanding the benefits

The right accounts receivable software has the power to transform your finance operations. It can reduce errors, improve cash flow visibility, and bolster customer relationships. Enhanced automation not only saves time and money but also ensures a higher degree of accuracy in your billing and collections processes.

Market comparison

Make use of industry reports and reviews to compare leading solutions. Take note of the customer satisfaction rates, as they can reveal a lot about the software's practical performance beyond the marketing claims. Request demos and trials to test how each software measures up against your list of features.

Leveraging expert advice in your search

In your quest to find the perfect accounts receivable software, advice from industry experts like G2 and Gartner proves invaluable. These platforms provide in-depth reviews and rankings based on user feedback and analyst reports, offering a bird's-eye view of how different software solutions stack up against their peers.

G2's user-generated reviews offer real-world insights into how software performs in various business settings, while Gartner's Magic Quadrant reports can help identify leaders, challengers, visionaries, and niche players in the market. Incorporating insights from these respected sources into your research process not only refines your software shortlist but also ensures that your final decision is informed by comprehensive and balanced viewpoints.

Consulting experts in the field

Even with the aid of research, the expertise of consultants can provide critical insights. Don't underestimate the value of experience in the complex task of choosing accounts receivable software. These professionals can advise on specific needs and help foresee potential challenges.

Seeking advice

Reach out to financial consultants or industry peers to gain advice on software selection. They can provide firsthand accounts of their experiences with different systems and might recommend options you haven't considered. This consultation offers a reality check on whether your expectations are aligned with what's achievable in the market.

Choosing the right consultant

Not all experts are made equal. When selecting a consultant, consider their industry track record and the success stories they can attribute to different software implementations. The right consultant should also be a good listener, able to tailor advice to your company's unique circumstances.

Customization and assistance

Ensure that the consultant can also address post-implementation needs. Issues such as customization to your specific business environment, employee training, and ongoing tech support are crucial components of a software's benefits.

Implementing accounts receivable software

The implementation stage is where your vision starts to take shape in the real world. This transition period must be managed carefully to avoid disruption to your financial operations and to ensure that the software's benefits are fully realized.

Integration with ERP systems

Seamless integration with your existing ERP or other financial systems is non-negotiable. In the absence of this, the software may create complications rather than solve problems. Define a clear integration strategy and engage both your software vendor and internal IT teams to ensure success.

Streamlining the collections process

The collections process is a critical area where accounts receivable software should shine. The ability to automatically prioritize and schedule collection calls or emails based on predictive analytics can drastically improve your cash flow. Ensure that your chosen software enables these advanced collection management features.

Uncomplicating the collections workflow

Read the solution guide

Enhancing the customer payment experience

The payment experience directly impacts customer satisfaction and, ultimately, your bottom line. An intuitive, branded customer portal that allows for various payment methods and easy tracking of invoices can set your business apart from your competitors. Work closely with your software vendor to design a portal that resonates with your customers.

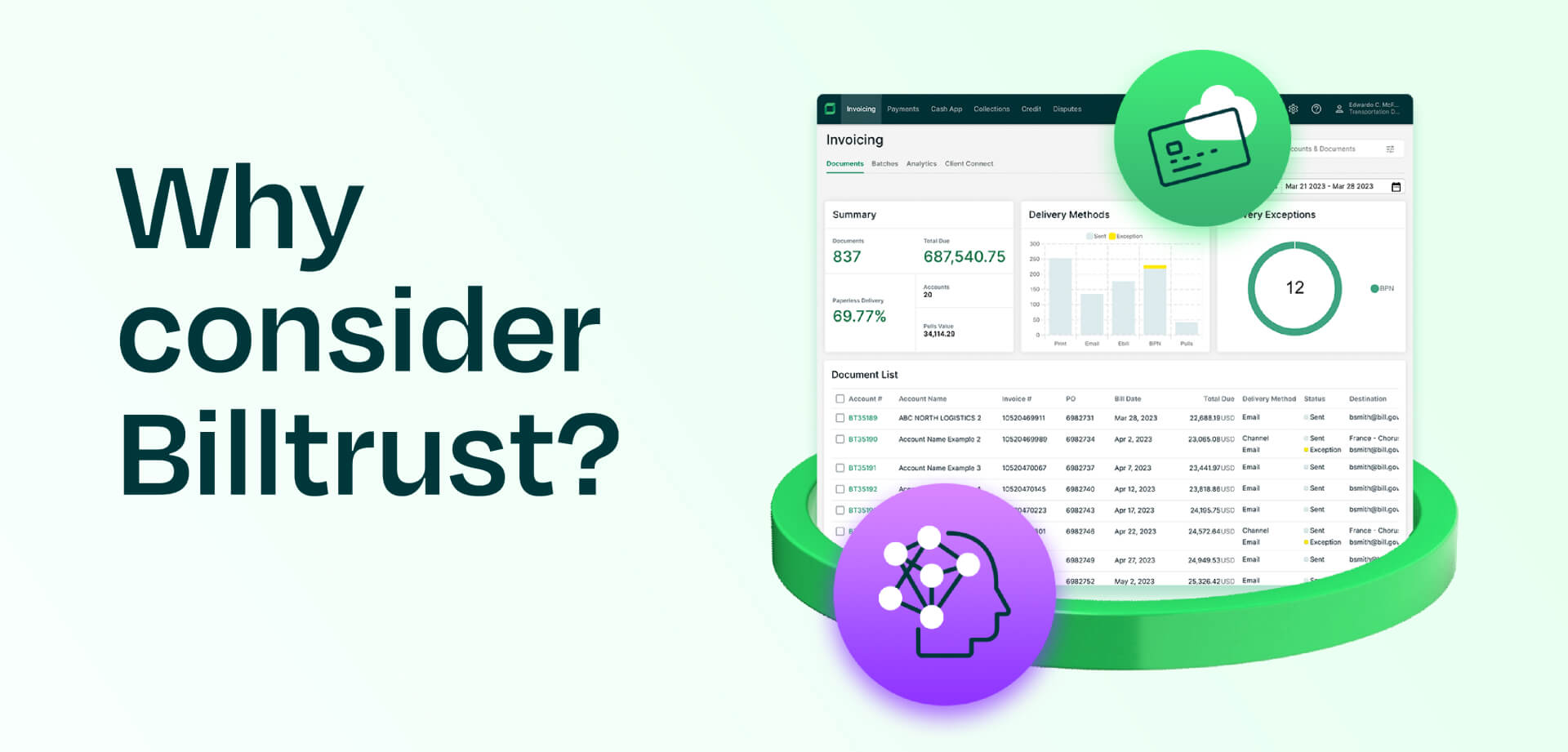

Why consider Billtrust?

Billtrust is a comprehensive, cutting-edge accounts receivable software that streamlines and automates the invoicing and payment process for businesses of all sizes.

Recognized for its robust suite of tools that enhance the efficiency of financial operations, Billtrust facilitates a seamless connection between suppliers and their customers. Key features include automated invoicing, digital payment processing, and an intuitive customer portal designed to improve cash flow and reduce the time-to-cash.

Additionally, Billtrust's commitment to innovation is evident in its continuous updates and integrations with the latest ERP systems, ensuring businesses stay at the forefront of digital finance solutions. This platform not only simplifies the accounts receivable process but also provides valuable insights and analytics, empowering companies to make informed decisions and strengthen their customer relationships.

Drive success with the perfect accounts receivable software match

The process of shopping for accounts receivable software can seem daunting, but with structured research, expert advice, and clear objectives, it doesn't need to be overwhelming. It is an opportunity to reevaluate and potentially revolutionize your financial practices.

By understanding the core features that matter most to your business, seeking the assistance of knowledgeable consultants, and ensuring seamless integration and implementation, you are on track to improve your accounts receivable and elevate your business to new heights.

Remember, the right software is not just a tool; it's a key ally in unlocking your company's full financial potential.

In the face of market complexity, Billtrust stands as a beacon of clarity, offering comprehensive solutions designed to streamline financial processes.

As you trek the path of software selection, consider the suite of tools and services offered by Billtrust, aligning the functionalities of their products with your unique business requirements. Make informed decisions, and your diligence will reward you with software that not only meets but exceeds your accounts receivable needs.

If you find yourself needing guidance or a partner to walk alongside you in this critical selection process, the experts at Billtrust are here to steer you toward success. With diligence in selection and empowerment through the right tools, 2024 is poised to be the year your accounts receivable process achieves excellence.

Download the Ultimate Guide to Digital Accounts Receivable

Want to learn more about accounts receivable software and how it can help your company move finance forward?

Talk with a Billtrust Expert today!