The construction industry plays a pivotal role in any worldwide economy. In the United States, the market size of the construction sector was valued at around $1.8 trillion in 2022, while in Europe estimates for 2022 ranged between $2.6 and $3 trillion.

However, the industry has faced several challenges. Over the years, emerging technologies like Building Information Modeling (BIM), drones, robotics, and augmented reality have permeated the design and construction processes. Construction firms and their suppliers have responded well and embraced these new technologies to improve efficiency.

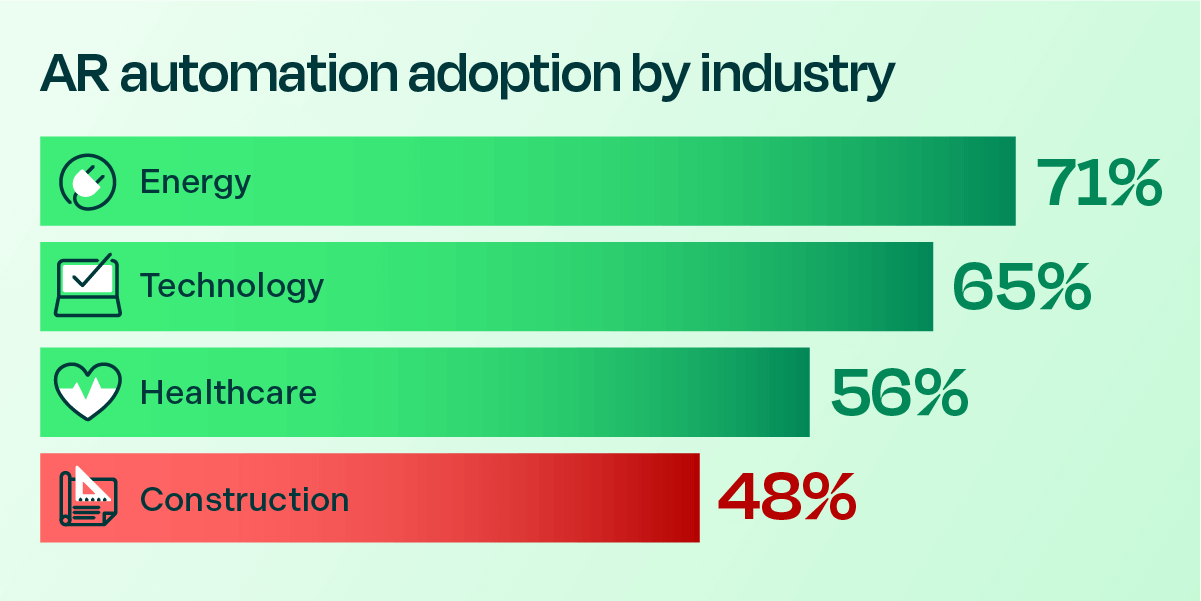

On the financial front, progress has been slower. Cash flow issues, delayed payments, and high transaction costs place significant financial strain on construction companies. Automating accounts receivable processes presents a solution, but the adoption rate of automated AR remains lower in the construction industry compared to other sectors. Only 48% of firms are using automated AR processes, trailing other industries like energy (71%), technology (65%) and healthcare (56%). This raises the question: Why has the construction industry been slower to adopt AR software?

Automated AR can assist construction firms in lowering processing costs and accelerating cash flow for their business. AR software can also free up valuable staff time, particularly when the absence of modern order-to-cash processes hinders the recruitment and retention of financial employees.

Achieving your financial goals

Below, we’ll explore the financial objectives that we’ve seen with construction and material supply firms. Each company may prioritize these financial objectives differently based on its size, market niche, geographic location, and long-term strategy. Additionally, economic conditions and industry trends may influence these goals over time.

- Profitability: One of the primary financial goals for construction and supply companies is to generate consistent profits. Profitability ensures the company's sustainability, growth, and ability to reward stakeholders, such as shareholders, owners, and employees.

- Positive Cash Flow: Maintaining a positive cash flow is paramount for every construction firm. With a positive cash flow, firms can meet their financial obligations promptly, compensate subcontractors and suppliers, and support both ongoing and new projects. Nonetheless, the construction industry often grapples with prolonged intervals between billing and collection, posing a challenge to sustaining a positive cash flow. Additionally, construction ventures frequently demand substantial initial investments, underscoring the critical need for adequate cash reserves.

- Cost Control: To stay competitive, construction firms and suppliers must control costs effectively. This means managing labor, materials, equipment, and overhead expenses to maximize profits.

- Project Profitability: Construction firms and suppliers strive to achieve profitability on individual projects. This involves estimating project costs accurately, managing costs throughout the project's lifecycle, and delivering projects on time and within budget.

- Revenue Growth: Many construction and supply companies aim for steady revenue growth over time. This growth can come from securing larger contracts, expanding into new geographic markets, or diversifying into different types of construction projects.

- Risk Management: Managing financial risk is critical. Companies seek to mitigate risks associated with project delays, disputes, changes in market conditions, and unforeseen events to protect their financial stability.

- Debt Management: If a company carries debt, its goal may include managing and reducing debt levels while maintaining a healthy debt-to-equity ratio.

- Asset Management: Effective management of assets, such as equipment and real estate, is essential. Companies may seek to maximize the utilization of assets and ensure they are well-maintained to extend their operational life.

- Compliance and Financial Reporting: Construction and material supply companies aim to meet regulatory and tax requirements while providing accurate and transparent financial reporting to stakeholders and investors.

- Sustainability: Increasingly, construction and material supply firms are focusing on sustainable financial practices. This may include investments in green building practices, energy efficiency, and environmentally responsible operations.

- Long-Term Viability: Construction and supply firms often have a long-term perspective, aiming to ensure the company's viability and growth for years to come. This includes succession planning and adapting to industry trends and changes.

Accounts receivable software in construction

If you're in construction or supplying construction materials, you know that accounts receivable can often be a big source of stress. Customers are behind on their payments, you have upcoming projects that need pre-financing, … and it’s difficult to keep tabs on receivables and outstanding payments.

Finance teams also need to do more with less - a trend observed across industries - and are not helped by an ongoing dependence on traditional practices, such as paper checks and manual processes.

As construction companies expand and require additional support in managing accounts receivable, they must explore alternative solutions beyond simply hiring additional, hard-to-find employees. That’s why there is starting to be more reliance on tech solutions like accounts receivable automation software to pick up that slack.

AR software can help construction businesses to better manage their unique construction accounts receivable needs, supporting firms to have cash-on-hand to finance the next big project. Automating payments and invoicing with accounts receivable software gives your team better control over the order-to-cash cycle. It's also a huge time-saver for your construction business, as it can handle a lot of manual billing processes for you. In addition, AR software can also help you keep track of payments, so you can follow up with customers who are behind on their payments.

Billtrust’s order-to-cash solutions tap into technologies such as artificial intelligence (AI), to reduce friction in the AR process and boost the speed of payments, ultimately helping you achieve your financial objectives.

Getting paid faster is the name of the game here, and, with Billtrust, there are myriad ways of doing so. One option is offering your customers choices in the way they make payments - for example virtual cards - and providing them with positive payment experiences along the way. With our surcharging programs you can even reduce the cost of customers making these card payments.

When there is low B2B adoption of online invoicing and payments, we can enhance technology with services to promote your portal to your customers, and increase online payments.

And when payment does arrive late, we can prioritize your teams’ time efficiently and let collectors determine which accounts to work on each day based on customers who need high-touch outreach.

The benefits of accounts receivable software

Even though the construction industry is slow to adopt AR software, your firm shouldn't hesitate to use it to achieve its financial objectives. Automated AR software can be a game-changer for construction businesses, providing the following benefits:

- AR software reduces the time and cost of invoice deliveries, regardless of customer expectations and shifting timelines.

- It allows you to easily adapt to varying customer payment methods including virtual credit card payments.

- By implementing a surcharge program you can reduce the cost and complexity of customers making these (virtual) credit card payments.

- With AR software, the time to apply cash can be drastically shortened, resulting in reduced labor costs, reduced bank costs and increased accuracy.

- Aging invoices, possible service interruptions, bad debt, and increased write-offs, are minimized with automated, state-of-the-art collections outreach.

- AR software allows you to protect your company from future disputes by quickly resolving discrepancies that would lead to late payments.

- Automation also improves relationships with customers and suppliers. A seamless customer experience helps with placing orders, accessing invoices and making payments efficiently online.

- By reducing the time spent on administrative tasks, businesses can free up staff to focus on revenue-generating activities.

The future of accounts receivable software in construction and material supply

The construction industry remains one of the most important industries in the world, and is ever-changing. As the industry evolves, it's important to stay ahead of the curve and choose an accounts receivable solution to scale your business.

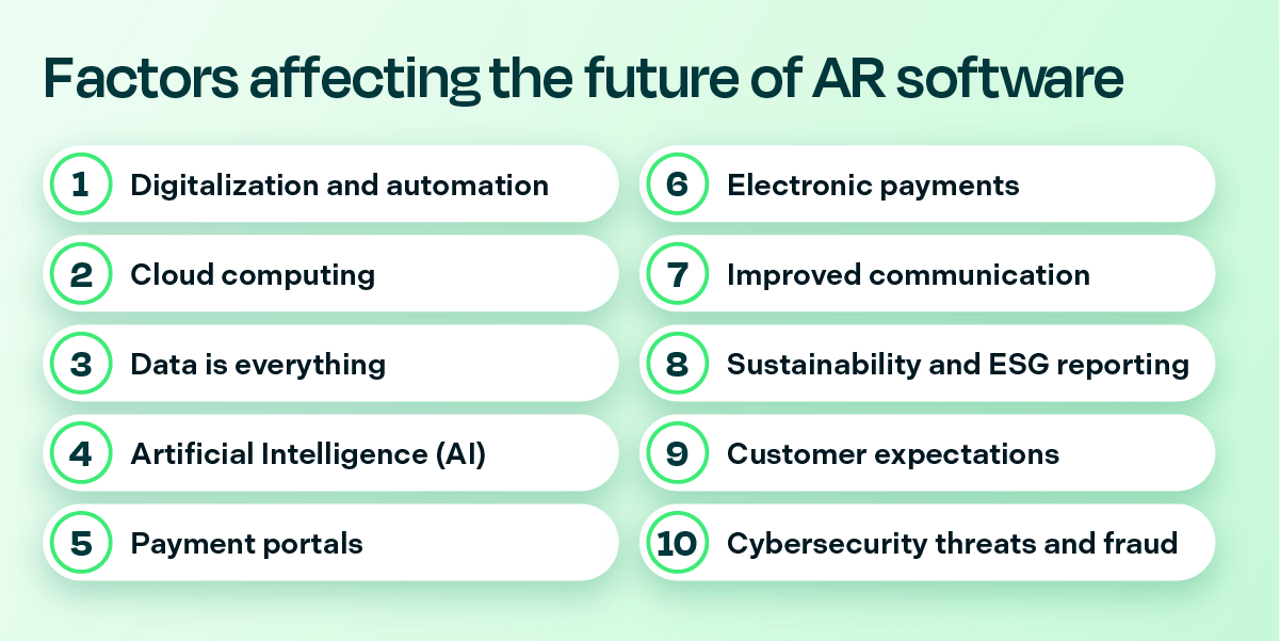

The future of accounts receivable in the construction industry is likely to be shaped by several trends and developments.

1. Digitalization and automation

In an effort to reduce errors and increase efficiency, construction companies are expected to increasingly adopt digital tools and automation in their accounts receivable processes. This includes automated invoicing, payment processing, and reconciliation.

2. Cloud computing

Construction firms and their finance and accounting teams must break free from the constraints of office spaces. Accessibility to work from any location is now imperative. Embracing cloud-based technology is the ideal remedy for this demand. By securely storing your records in a safe and secure cloud repository, you have real-time access to financial data, improved collaboration among project stakeholders, and easier integration with other software systems.

3. Data is everything

Data analytics tools will be used to gain insights into accounts receivable trends and customer payment behavior. This data-driven approach can help companies make informed decisions and optimize their invoicing, credit and collection strategies.

4. Artificial Intelligence (AI)

AI will play a major role in accounts receivable solutions in the future. It can help finance professionals be even more productive by automating time-consuming tasks and answering questions. When combined with analytics, it can give finance leaders a better overview of cash flow.

5. Payment portals

Construction companies may provide customers with convenient payment portals and mobile apps, making it easier for them to pay invoices and access account information. This enhances customer satisfaction and speeds up the payment process.

6. Electronic payments

Electronic payment methods, such as ACH transfers, virtual cards and digital wallets, will likely become the preferred choice for transactions, reducing reliance on paper checks.

7. Improved communication

Enhanced communication and collaboration between construction companies and their clients, subcontractors, and suppliers will be facilitated by digital channels. This can lead to quicker dispute resolution and payment settlements.

8. Sustainability and ESG reporting

As sustainability becomes a greater focus in the construction industry, accounts receivable systems may incorporate features to track and report on sustainability metrics, including timely payments as a factor in supplier evaluations.

9. Customer expectations

Meeting customer expectations for streamlined, user-friendly accounts receivable processes will continue to be a priority, as clients increasingly seek efficiency and transparency.

10. Cybersecurity threats and fraud

The construction sector is the most targeted by cybercriminals. The sector is highly vulnerable to outages which may explain why they are more targeted by criminals. There is also the trend for more fraud in credit card payments. Automated AR and digital payments protect sensitive information and reduce risks.

In summary, the construction and material supply industry is heading towards increased efficiency, digitization, and a customer-centric approach in the future of accounts receivable. Construction companies must prioritize the adoption of technology and data-driven strategies to streamline financial processes, enhance cash flow management, and remain competitive in a rapidly evolving industry.