Diving into the potential future landscape of data and analytics, it becomes evident that Artificial Intelligence (AI) is an integral force to reckon with.

Within accounts receivable (AR), AI holds the potential to deliver numerous advantages, such as automating tasks, improving accuracy, and reducing costs. Billtrust is at the forefront of this revolution, with a vision to use AI to lay the foundations for future AR insights.

AI provides many benefits to the AR process

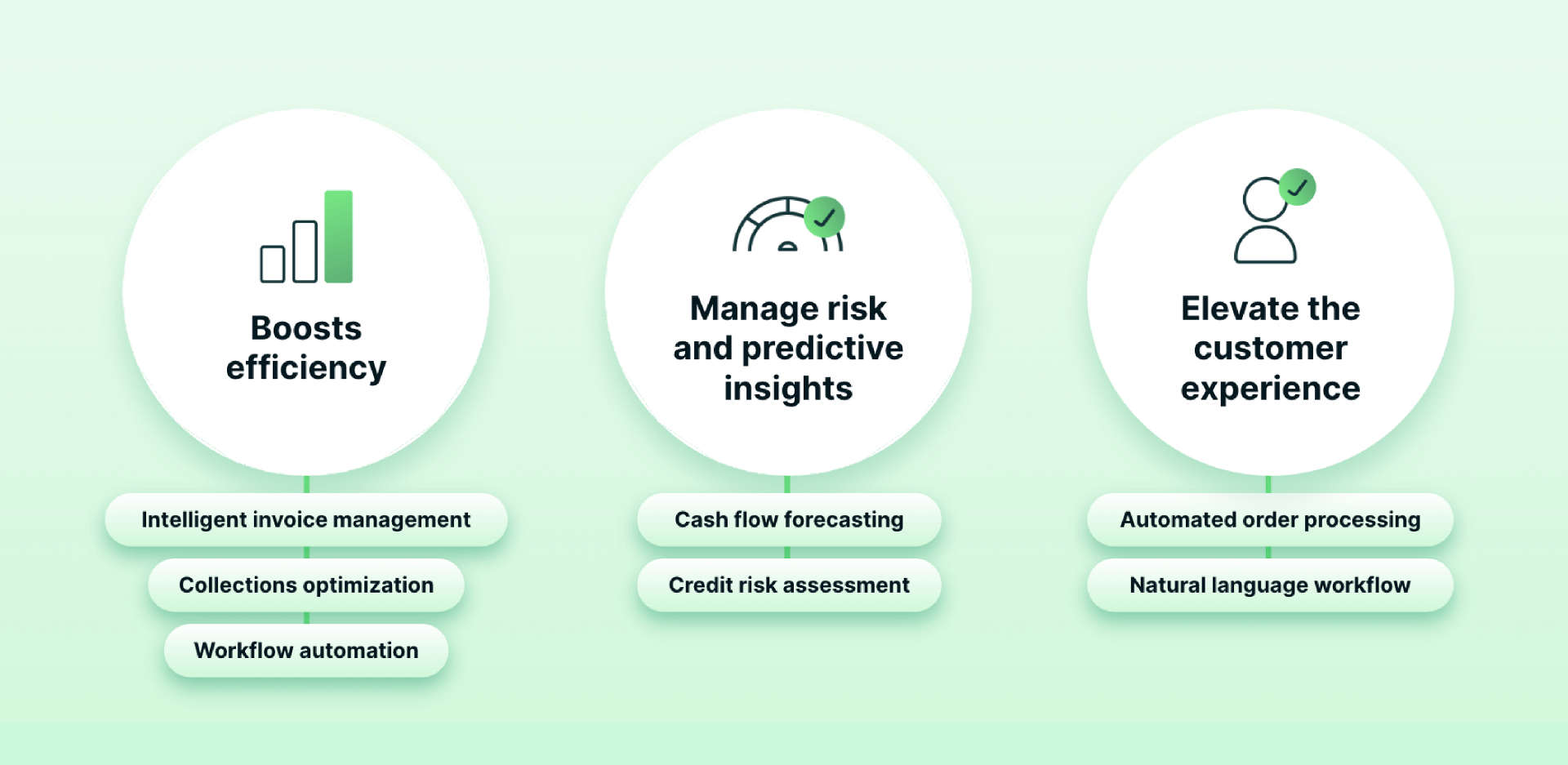

Here are some specific examples of how AI can be used to improve the AR process:

- Boosting efficiency. AI can automate many of the manual tasks involved in AR. Think about more intelligent invoice management (ChatGPT for invoice data search), collections optimization, and workflow automation. This can free up AR professionals to focus on more strategic tasks.

- Managing risk and providing predictive insights. AI can be used to identify potential risks in the AR process. With tools to forecast cash flow or assess credit risk late payments can be seen before they go bad and the right credit limits can be superimposed on customers. This can help AR professionals take steps to mitigate these risks and protect their company's financial interests, but also make better decisions about pricing or credit terms, move more to intelligent collection strategies and predict payments.

- Elevating the customer experience. AI can be used to personalize customer communications and help teams to draft payment reminder emails, or to automate order and invoice processing with natural language workflow.

How unifying your receivables leads to better insights

The value of data and analytics cannot be overstated, and the utilization of both traditional and generative AI can push this concept even further. Ahsan Shah, Billtrust Senior VP Data Analytics: “A big part in providing better insights for AR teams is not only analytics, but also machine learning and ultimately generative AI. With combining all these technologies we can give you a full view of every business process in AR, and that’s what we at Billtrust are striving to do.”

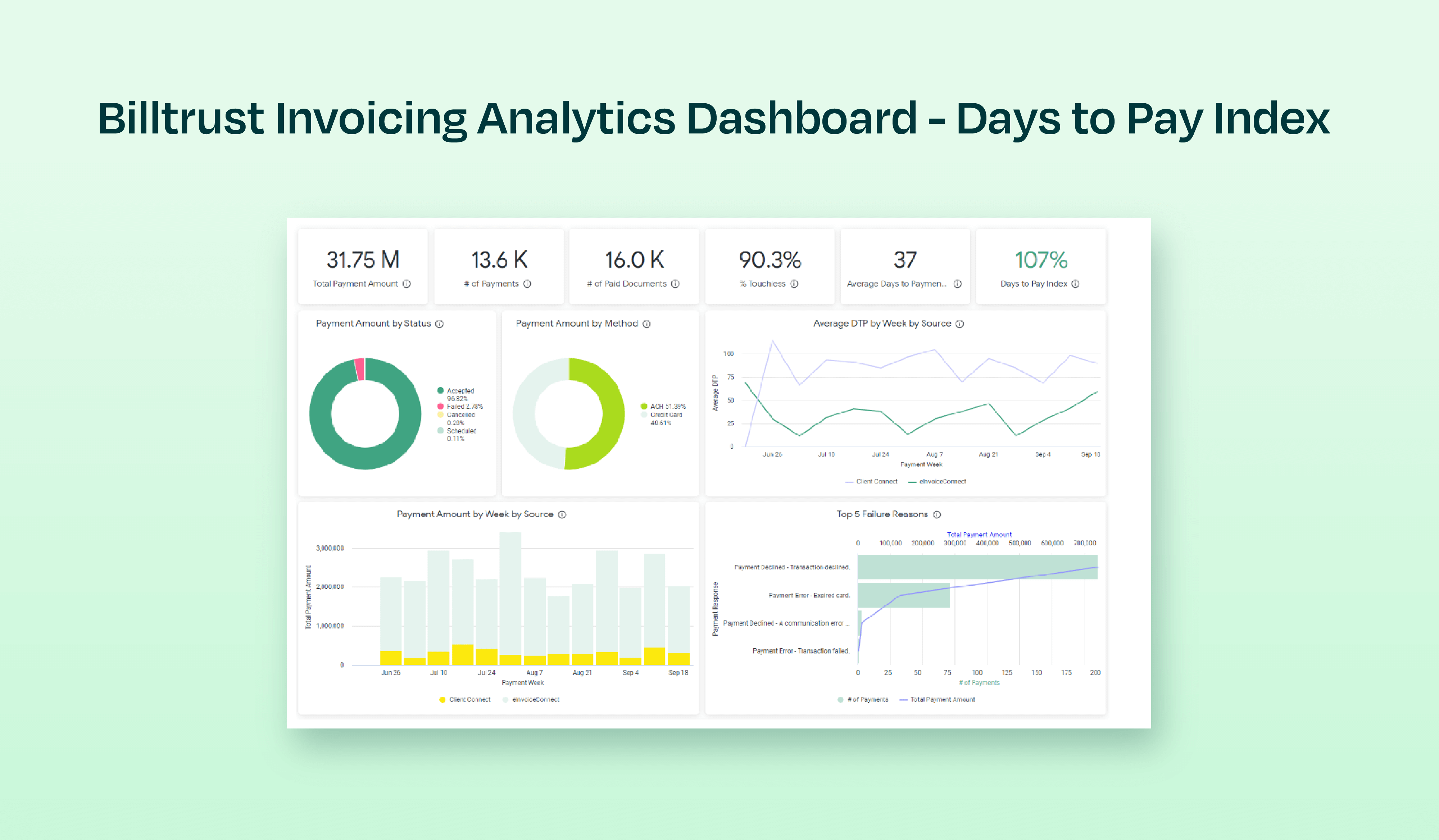

Benchmarking with the Days to Pay Index

A particularly intriguing field involves cohort comparison, where we delve into benchmarking that empowers customers to assess their performance against similar industries from an AR perspective.

Illustrating this concept of cohort comparison, is a new feature called the Days to Pay Index, a first ever insight into your days-to-pay performance against an industry benchmark. It is based on the Days to Pay (DTP) metric by which Billtrust Invoicing customers know how long on average it's taking customers to pay them. Days to Pay is a derivative to DSO, and is based on open balance data.

The Days to Pay Index can be populated with companies in your industry, which are hidden for obvious privacy reasons. It is meant to provide a basis for decision-making and saves you a ton of time.

Ahsan Shah: “We're using our network of information across our partners and suppliers and their buyers to give intelligence on how they are doing outside of just their myopic view of their business. Cohort comparison, as in the case of the Days to Pay Index, is something we think about for other Billtrust products as well.”

Making smart recommendations

“Looking further ahead, we’ll have the ability to make recommendations on how to improve your relative standing, " says Kiele Lowe, Billtrust VP Product. "If your Days to Pay is 68 and the average for your cohort is 85, your index would be 125% and you should feel good about your efforts. But if your Days to Pay is worse than the benchmark, you would have a lot more questions to ask and we would be looking to surface answers for you. We can help you with what is happening within these cohorts."

What if you could have an interface into your AR solution through which you can conversate? An agent that is always available answering questions? That’s exactly what we are experimenting with right now, says Ahsan Shah. “Thanks to language models that use text-based machine learning, such as ChatGPT, you can ask questions in natural language and have answers returned based on all your AR data. It is exploratory right now, but could potentially lead into this constantly available conversational agent for any Billtrust solution.”

These new developments and features play well in the vision that Billtrust has for connected AR. Ahsan Shah: “What we’ve found out when listening to customers, is that they want guidance on next steps, on to do’s, they want a nudge in the right direction. They want to spend less time in the system, … spend more strategic time in the system.”

AI-powered overview of the AR process

Things really get interesting when data, analytics and AI can be used across products and across the entire AR process, says Ahsan Shah. “All the data you have already collected about customers and their payments can be used to assist you with your workflow, make recommendations and suggestions, and even help you compile personalized payment reminders to these customers.”

“That’s exactly what we are doing right now. We offer an AI-powered, complete view of customers’ activity across your entire AR process, enabling you to make intelligent AR decisions.”

“It can start out with basic predefined alerts that let you know when important data points or key metrics start to change. Eventually it can evolve into more personalized alerts and guidance advice, tailored to the industry you're in. If we take a peek into the near future, that’s where generative AI driven workflows come in. Think about tools on how to optimize your cash flow or payment channels, or workflows adapted to the office of the CFO or directors. We’re laying the foundations for all that right now.”

Ultimately, the convergence of data, analytics, and AI holds the key to a transformative AR experience. It's not just about being autonomous; it's about delivering precise analytics alongside individualized insights, suggestions, and AI-fueled processes to the appropriate individual precisely when needed.