Customer data has long been the holy grail for overworked accounts receivable departments. Yet even with seemingly endless amounts of valuable customer data, winnowing through it and identifying trends to improve your AR processes is, at best, a headache and, at worst, impossible.

“Data may be plentiful, but information is obfuscated across a lot of different platforms,” says Doug Appelson, Billtrust’s Senior Technical Manager. “It’s difficult in this environment to be able to take a step back and look at things more strategically when so much of the information you’re interacting with is so transactional.” He maintains that artificial intelligence and analytics can be true gamechangers, enabling breakthroughs in how data is used. Appelson has been a speaker at Billtrust’s Executive Exchange, a series of explorative sessions with innovation-learning finance experts.

Here are three ways, current and future, that Appelson believes analytics and AI can help AR teams strengthen their processes.

1. Spot timeliness drift in AR processes with AI

Pinpointing which of a company’s thousands of buyers are paying in a less timely manner and standing in the way of optimizing days sales outstanding (DSO) is critical to a successful AR process.

“Regardless of what industry you’re in, how quickly you’re collecting funds is paramount,” Appelson says. What’s more, with interest rates as high as they are today, the negative financial impact of late payments is magnified.

“Managing DSO” is easier said than done. “Being able to see DSO across hundreds of thousands of buyers can be really challenging,” Appelson says. “A lot of times, businesses lose track of who’s becoming slower to pay them.”

So, in June 2024, Billtrust added an analytics workspace to its platform, allowing companies to use its Payment Analytics module to track how DSO is trending over time.

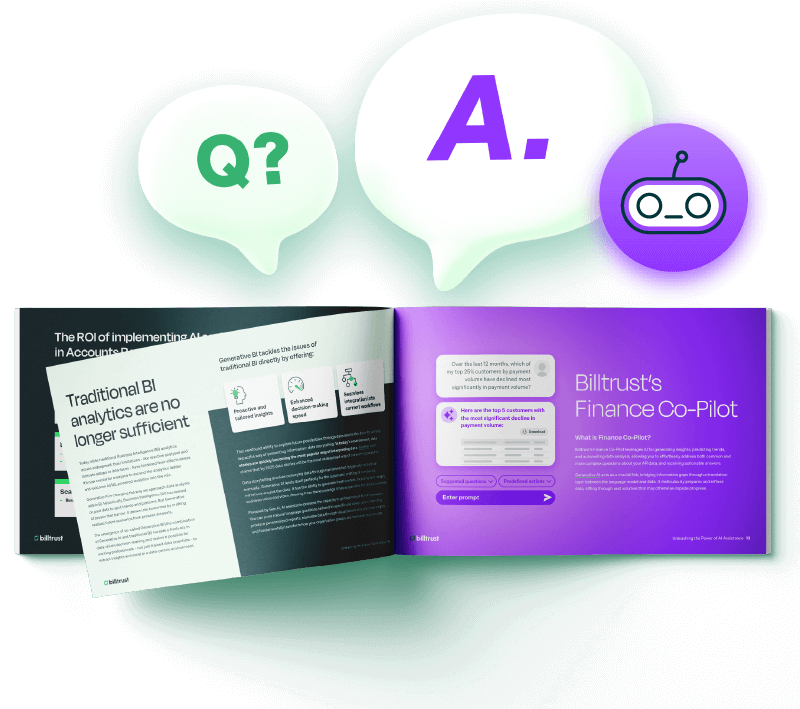

Making things simpler still, Billtrust introduced Finance Co-Pilot the following month. Co-Pilot has a generative AI feature that allows companies to ask questions in plain English. It’s now possible to get near-instantaneous answers for a question like this one: “Which of my largest buyers have declined in their days to payment in the last month, and how quickly were they paying me six months ago?”

Read the blog post → Transforming accounts receivable with AI: Meet Billtrust’s Finance Co-Pilot

2. Use AI to identify buyers who are slowing down reconciliation

Even such simple irregularities as smudged ink or a missing invoice number can mean that reconciling a payment suddenly becomes an enormous time suck.

“If you only had 10 customers, [these irregularities] wouldn’t be a problem,” Appelson says. “When you’re talking about thousands of customers, being able to instantaneously understand which of your customers are basically the ‘problem children’ matters.”

As part of its analytics suite, Billtrust lets customers identify buyers that are slowing down reconciliation. In the future, artificial intelligence will likely make communicating with late payers a snap. Appelson notes that with generative AI, AR systems may soon be able to reach out to buyers with sloppier practices and automatically ask for more complete remittance information.

On the fly, companies will also be able to change when and to whom correspondence requesting additional information is sent, whether it’s to buyers providing remittance information less than 90% of the time or to those who never provide the necessary information at all.

3. Benchmark against peers and competitors with AI and analytics

Companies today can use Billtrust’s analytics to assess how quickly one buyer is paying compared with others. Far more powerful, Appelson says, is the ability to track how promptly a given buyer is paying your company compared with how promptly it’s paying others.

Looking to the future, Billtrust is aggregating and anonymizing payment data to create indexes by industry, so its clients have greater insight into the timeliness of customer payments.

Appelson believes that this type of information can be enormously useful when AR heads speak with their CFOs or CEOs about the success of AR. Instead of simply presenting evidence about the efficiency of their own AR processes, AR leaders will soon be able to measure progress against an industry benchmark or scorecard.

“If you don’t have any idea how others in your industry are performing, your reporting becomes insular,” Appelson says.

“We see opportunities to set up benchmarking for cash application, match rates, and electronic presentment,” he concludes. “These things matter for any business that wants to collect funds faster and reconcile funds in a more efficient way.”

Curious about how Finance Co-Pilot can transform your AR process? Dive deeper into this game-changing solution by reading our comprehensive eBook. Get your copy now by clicking the download button below.

Unleash the power of AI assistance today and strengthen your company's financial future tomorrow.

Download the eBook