According to a recent Billtrust/ IDC survey, one of the major aspirations for companies is to drive greater efficiency across their organizations and teams. Failing to consider and adopt AI and machine learning could have detrimental consequences for your business in the long term, incurring substantial costs related to invoice processing, collections calls and reminders, as well as lockbox fees.

When it comes to AI, there's no turning back. It will revolutionize businesses and processes, undoubtedly for the better. However, have you ever pondered how to maximize AI's potential and leverage your data intelligently? The key lies in posing the right questions to equip yourself for AI implementation and extract the maximum benefits from your solution.

“By leveraging AI, your business can increase efficiency, accuracy and productivity, leading to better business outcomes. And by taking the proper steps beforehand and deploying AI with care, you can ensure your AI realizes its full potential.”

Vice President of Integrated Payments, Billtrust in Forbes

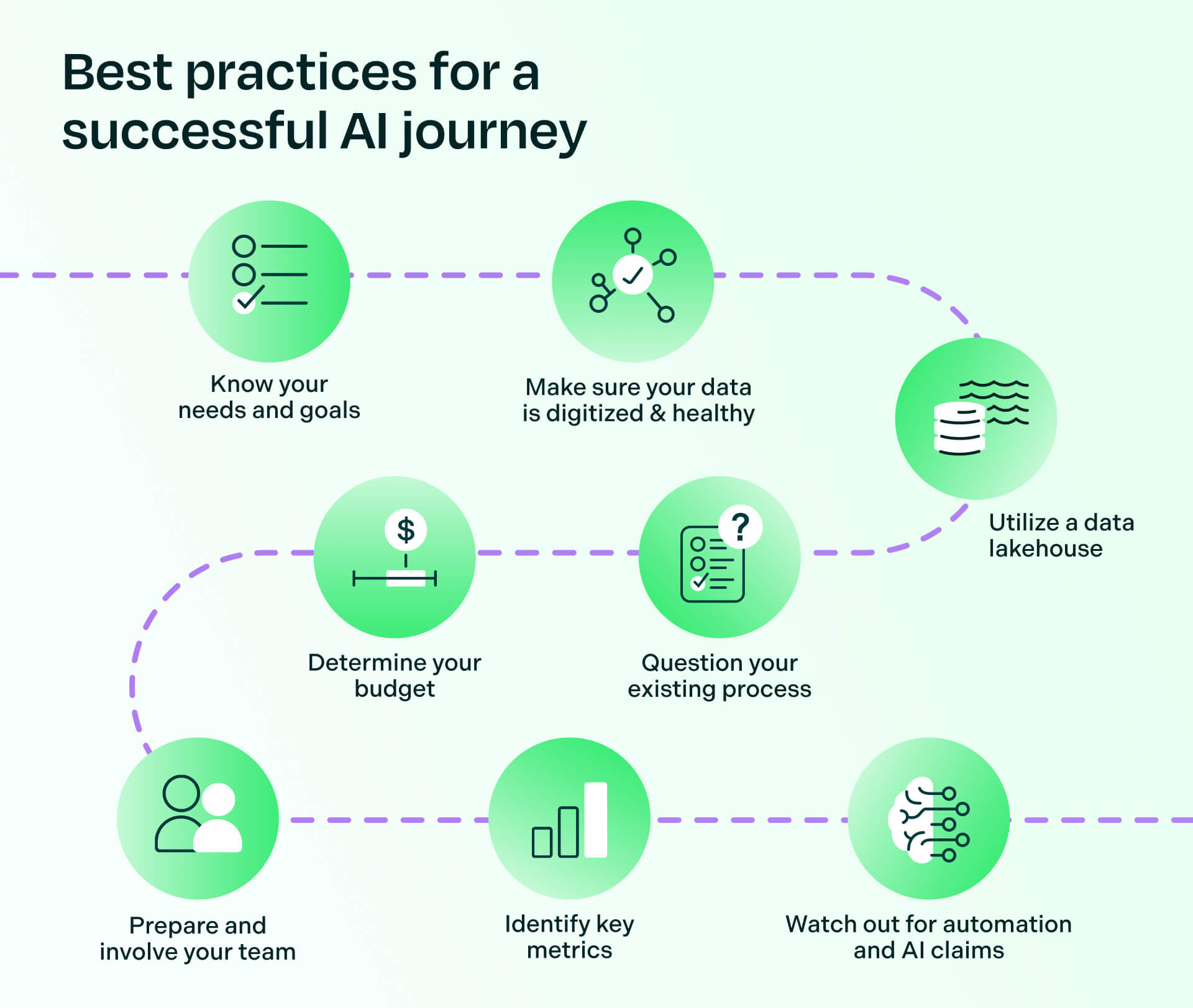

1. Have a clear understanding of your organizations needs and goals

While AI and machine learning can perform some extraordinary feats, implementing it is not a silver bullet solution. It’s important to have a clear understanding of your organization’s needs and goals before weaving it into your processes.

Developing use cases is an important step in the AI implementation process. They help give direction to AI teams by providing concrete examples of the business problems or needs that AI can help solve. This could include streamlining processes, improving customer experience, reducing costs, or increasing efficiency. By clearly defining the problems you want to solve, you can ensure that the AI solutions you develop or buy are targeted and effective.

2. Make sure your AR data is digitized

Without quality data any AI model will produce poor quality output. Getting data of the highest quality should be a top priority. Make sure the datasets you will use are healthy, prepared, and validated before you sign them off to use for any AI efforts. This implies digitization of accounts receivable data, such as invoices, payments, credit, and collections data.

3. Understand the importance of a data lakehouse

Somewhat related to the previous topic is the way data is being collected and integrated. You should have a clear understanding of your data infrastructure. There should be a streamlined process set up to collect and integrate data from various sources, such as invoicing systems, customer relationship management (CRM) software, and payment gateways.

When all this data can be pulled into a data lakehouse, meaningful analysis and more in-depth and innovative intelligence is possible.

4. Ask some tough questions about your existing AR processes

For quite some time, the payments industry has been dominated by the mindset of 'If it's not broken, don't fix it.' However, this outlook is evolving, driven by the ongoing digitalization and data explosion. This necessary transformation calls for a thorough evaluation of your current AR processes, which can yield valuable insights. When this data is meticulously analyzed, it reveals untapped efficiencies.

5. Determine the impact AI will have on your budget

AI technology can come with significant expenses. When collaborating with external vendors for your AR transformation, it's crucial to be informed about the associated AI costs. Some vendors may add extra charges for AI within their products or offer AI as a separate, premium product. On the other hand, some vendors are integrating AI features into their solutions without increasing the overall product cost. Evaluate each vendor's reputation and determine whether the proposed solution aligns with your existing infrastructure.

6. Prepare and involve your team early on

It goes without saying that, in order to get your processes and data sorted, you need to set aside time for people within your business. And that often means bringing everyone into the discussion and/or process sooner rather than later.

It's fundamental to understand that AI implementation isn't just about purchasing a tool and expecting it to work seamlessly with your existing processes. Instead, it's a collaborative effort that requires active participation from your team. By involving people within your business early in the process, you're not only acknowledging their expertise but also ensuring that the AI aligns with your specific needs.

Before implementing AI, it's essential to clearly define the features and benefits the AI tool will provide to your team. This involves understanding how the AI will enhance your existing processes, whether it's automating repetitive tasks, providing predictive insights, or improving decision-making.

Consider how the AI tool will impact your workflows. Will it make them more efficient? Will it allow your team to focus on higher-value tasks while automating routine work? Understanding the potential workflow improvements can help in setting realistic expectations and measuring the success of AI implementation.

7. Identify key metrics

To optimize your AR processes, it's essential to pinpoint the Key Performance Indicators (KPIs) that hold the greatest significance for your department. These KPIs serve as vital metrics to track your AR's efficiency and performance. Consider metrics such as Days Sales Outstanding (DSO) to gauge how quickly you're collecting outstanding payments, aging receivables to monitor overdue invoices, cash application accuracy to ensure precise payment allocation, and customer payment trends to understand payment behaviors.

In addition to these core KPIs, it's crucial to take into account the investment your team puts into the AR solution and the resources required from your IT teams. This comprehensive evaluation allows you to calculate the ROI for the solution you're contemplating. Understanding the relationship between these KPIs and the ROI helps you make informed decisions regarding the effectiveness and sustainability of the solution in improving your AR operations.

8. Watch out for automation and AI claims

In today's rapidly evolving business landscape, the buzzwords "automation" and "AI" are frequently used, sometimes interchangeably, by companies seeking to showcase their technological prowess. However, it's crucial for businesses and decision-makers to exercise caution and discernment when evaluating these claims.

Not all claims of automation and AI are created equal. Some companies may have genuinely integrated advanced automation or AI into their processes, while others might have only taken initial steps in this direction. It's essential to dig deeper and understand the specific features, capabilities, and limitations of the automation or AI being offered.

Curious about what AI can do in the world of accounts receivables?

Find out more in our white paper Leveraging AI to help your AR operations thrive in 2023.

Get your copy of this exclusive guide to learn:

- Basic background information on AI, its milestones and challenges

- Use cases of AI in accounts receivable (AR) and the order-to-cash cycle

- How AI can help in improving AR business processes

- 10 steps for accelerating your AI journey and achieve sustainable success

Dive deeper into AI

Want to learn more about how we're transforming AR with AI and machine learning?