Over the past two years, companies began challenging their reliance on legacy systems and wondered how to improve their manual processes. Organizations were no longer satisfied with the status quo.

Automating financial processes offers a lot of opportunities, says Liz Herbert, a VP and Principal Analyst at Forrester Research. She recently was a guest speaker at a Billtrust webinar where the discussion focused on the most pressing cash application challenges burdening AR departments.

She pointed out that industry trends toward automation are not going away and will only grow more important. Liz says that automating finance is a must to take your business to the next level. But finance transformation needs to keep pace with business needs. Finance often receives extra attention than the customer- or employee-facing systems.

That needs to change. Businesses should embrace automation as a way to keep growing. In a 2022 survey, Forrester Research found that 73% of organizations say growth is a top priority (up from 40% in 2021), and 71% also say improving products and/or services is at the top of their minds.

Also, a recent study from Juniper Research has found the global transaction value of the B2B payments market will exceed $111 trillion in 2027. The report specifically identified increased automation of accounts payable and receivable as critical to the growing efficiency of payments processing and a way for businesses to unlock significant cost savings.

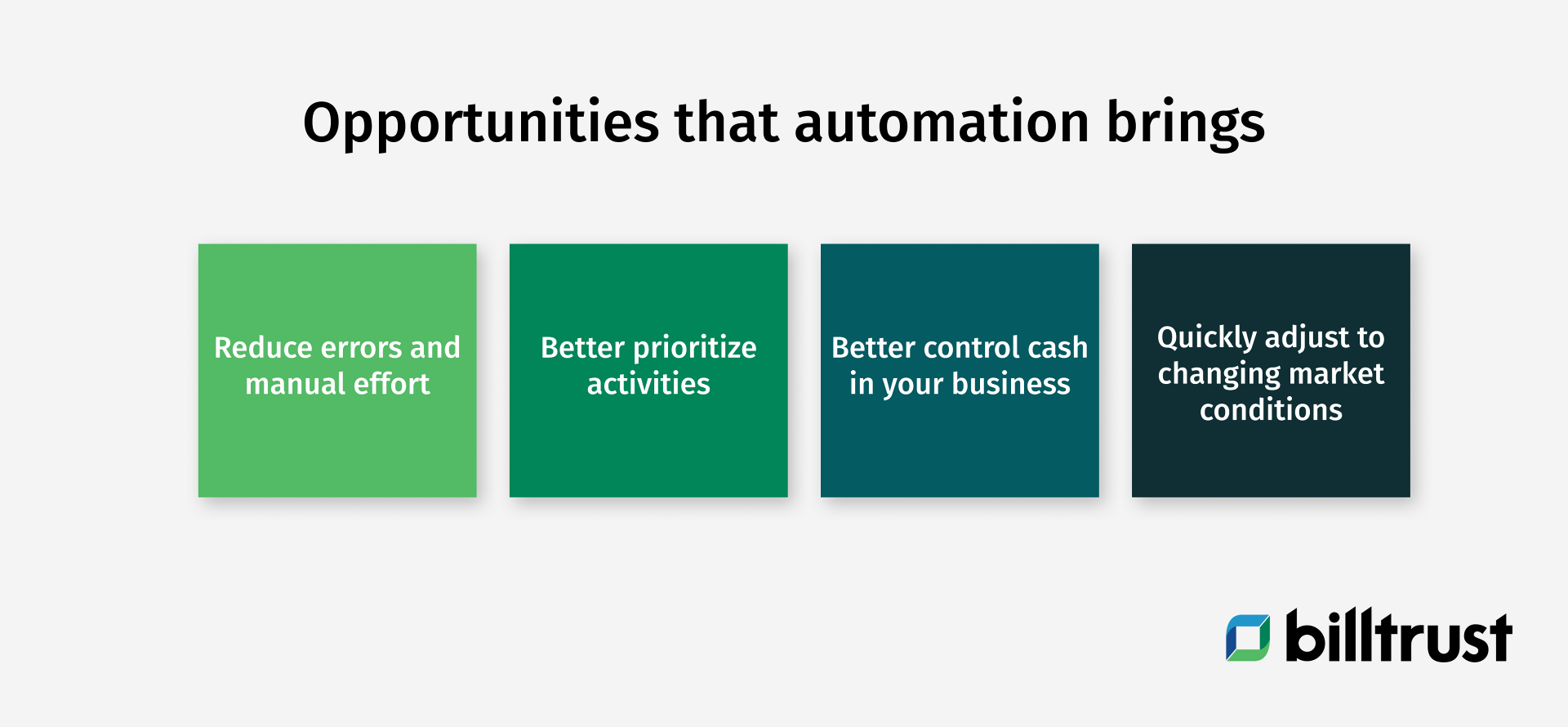

Automation brings opportunities

The opportunities that automation brings should come as no surprise to businesses. Liz Herbert, Forrester Research, lists a few:

- Reduce errors and manual effort. Automation reduces manual work and allows your AR team to focus on more high-level projects.

- Better prioritize activities. Knowing what needs to be accomplished each week and month provides a better scope of work your accounting department.

- Better control cash in your business. We all know getting cash in the door and speedily applying it to open balances is a mission-critical activity.

- Quickly adjust to changing market conditions. Leading organizations must be “Future Fit,” a model Forrester developed describing how a leading organization needs to operate to survive and thrive in the future. Two key themes are ‘adaptive’ (being able to change quickly) and ‘creative’ (getting away from traditional processes and thinking/working differently).

B2B interactions can improve as a result of automation’s realities. But how do you go about automating finance processes? Herbert has some tips. She said to explicitly look for solutions that offer exponential value with many-to-many relationships and to involve users in technology decisions. She adds: “Don’t just simply replicate today’s needs and processes but imagine the possibilities.”

Automated AP comes with challenges for AR

Increasingly, buyers demand that suppliers feed their invoices into accounts payable (AP) and buyer portals. By 2025, over 50% of the global midmarket and large enterprises will have deployed AP portals, according to Gartner.

Automation will play a big part in the AP function. Labor costs are rising; it's getting difficult to hire new people. The prospect of having a manual workday is not very enticing. At the same time, there's an explosion of opportunity for the automation of remittances and payments. Why? Because it improves the accuracy and productivity of those workflows.

You would expect automated AP to speed up payments, but it can bog them down. AR teams must feed invoices to these AP portals and often manually key them in. And the work isn’t getting easier when team members deal with multiple and different AP portals.

Accelerate payments

Partnering with a state-of-the-art AR automation platform enables the straight-through processing of invoicing, payments and cash application while minimizing security risks and ensuring compliance – not to mention the reduction in labor costs and human error.

Let’s talk about ways to accelerate payments, including automating invoice delivery and cash application.

Automating invoice delivery

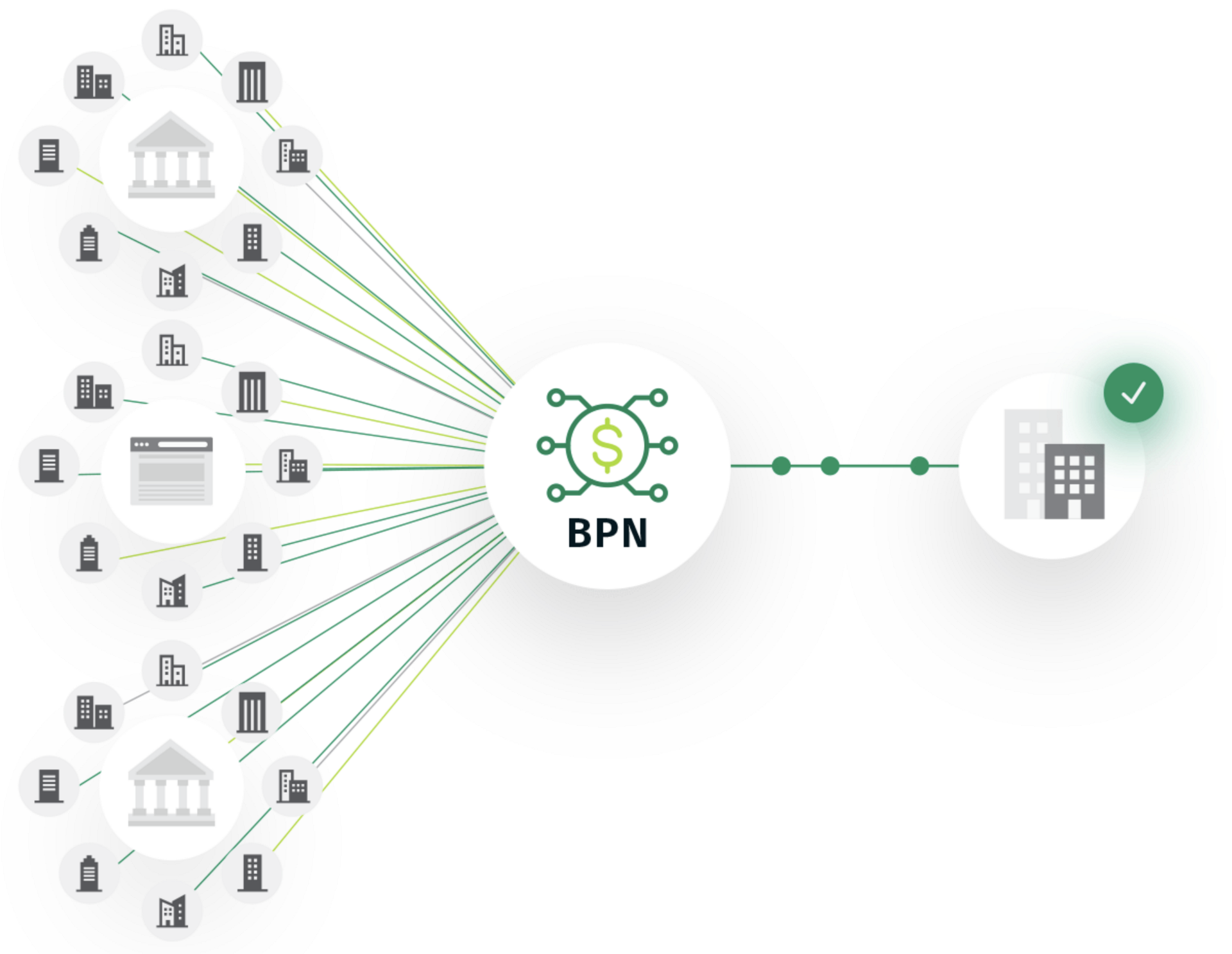

The right AR automation provider should have an electronic payments network that makes it simple and seamless to work with AP portals, eliminating the manual workloads we’ve touched on above.

Billtrust’s Business Payments Network (BPN) Invoicing ensures that businesses can get their invoices into every required portal on time and in the correct format. With an automated invoice delivery process: invoices are uploaded to your buyers’ AP portal once the invoice data is in our solution. Increasingly, that delivery is becoming less hands-on through robotics and API integration. Currently, we deliver invoices to more than 175 AP portals.

When the invoice is automatically imported into the customer’s AP portal, BPN acts bi-directionally. You'll receive status updates on invoice delivery and any exceptions and rejections that may occur.

What a typical cash application process looks like

Once your invoice is received, it’s time to get paid quickly. Customers pay with paper checks or through electronic payment sources such as ACH, (virtual) credit cards, SEPA, accounts payables portals, etc.

AR teams then receive the payment data from the banks. Customers also send remittances, that is, documents containing information, such as the reason for the payment. Or for which invoices the payments were made.

Accounts receivable teams must match incoming payments with open invoices during cash application. This means manually processing hundreds of remits and typing remit data into ERPs by hand. Some payments are easy to match, and the ones that aren't get marked as exceptions.

Companies can only realize cash once payments have been properly matched and applied to the correct account. Cash is only posted to the ERP, and that account's open balance is updated.

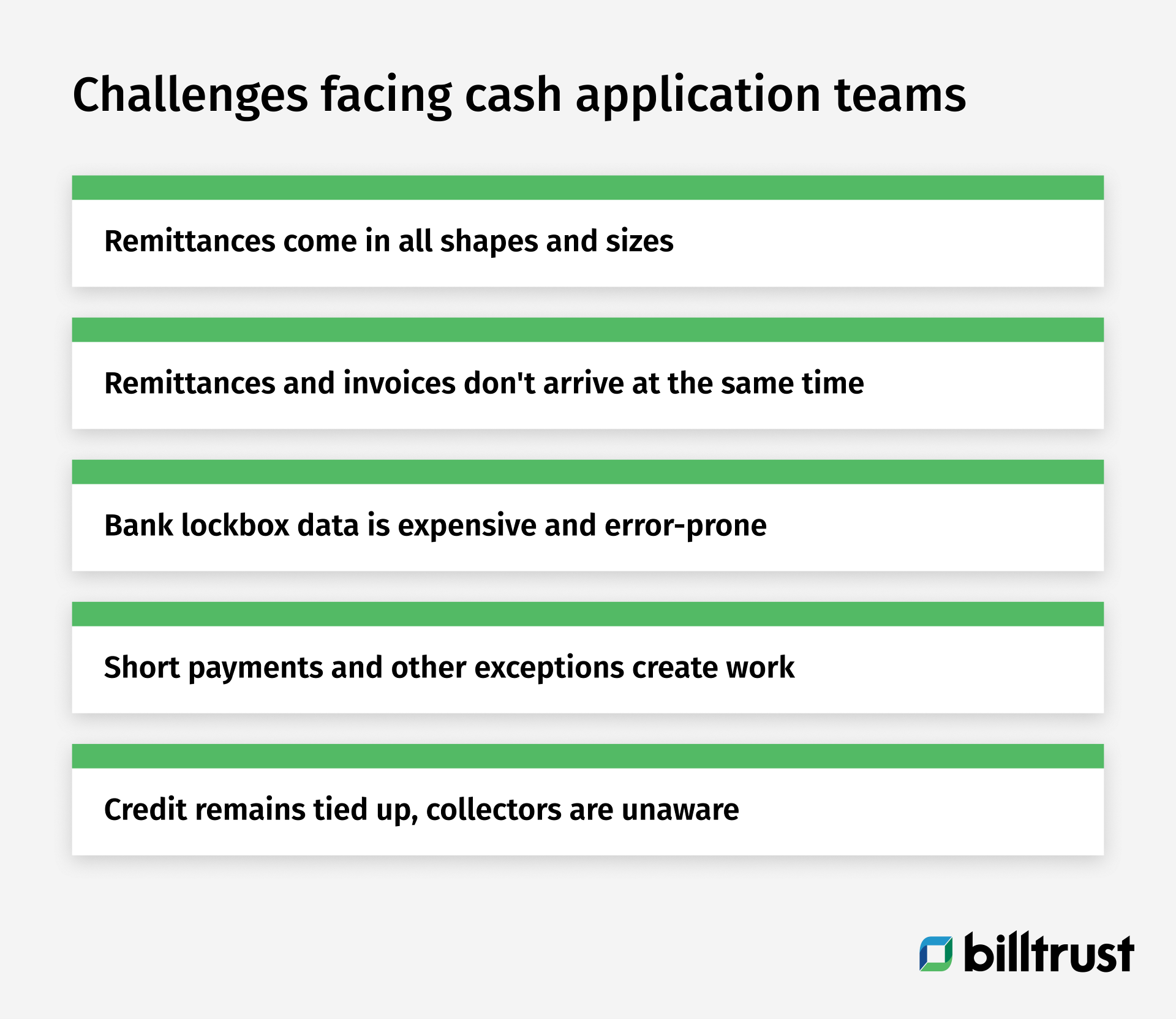

Challenges facing cash application teams

Payments are growing more complex and labor-intensive, making it challenging for cash application departments. Plus, they also deal with nonstandard remittances from disparate payment sources.

If a business relies on an outdated, manual process, this can be time-consuming, ultimately extending DSO. And we all know that working capital is essential for any CFO and, by extension, a business.

Furthermore, delays in cash application impact a customer's credit for ordering goods or services, which then affects a supplier's business.

Today, teams lose time because:

Remittances come in all shapes and sizes

Some remittances put the invoice details in the body of the email, while others send an attachment, and others send remittance data with the transaction. Many buyers require suppliers to log into online accounts payable (AP) platforms and portals to retrieve remittance data. These nonstandard remittances from many payment sources and in many different formats mean manually processing and typing remit data into ERPs by hand.

Remittances and invoices don’t arrive at the same time

Decoupled remittances are growing with the adoption of electronic payments. Tracking down these remits is time-consuming. Cash application teams need to extract or download these remittances manually.

Bank lockbox data is expensive and error-prone

Bank lockbox services process every check and prepare an electronic file to send to your cash application team. But banks typically charge per check (key-in fees), and depending on the number of checks; this can quickly become expensive. Also, errors occur, and re-processing these checks adds extra time and costs.

Short payments and other exceptions create work

It's rare for a customer to pay perfectly. Short payments happen regularly and for different reasons:

- Customers want their trade promotions.

- They dispute certain goods or services.

- They want to record an early payment discount.

Also, over-payments can happen.

Again, these exceptions bury staff in manual work: they must identify short payments or over-payments. Usually, customers highlight the reason for the short payment, and AR teams need to match any reason codes the customer has given to the reason code the ERP is using. That's before the data enters the ERP and cash can be posted.

Credit remains tied up, and collectors are unaware

Until cash can be applied, credit remains on hold. This can slow down business. And collectors, unaware of customers who have already paid, might send out unnecessary reminders and attempt to collect on paid invoices. This doesn't provide a great customer experience.

These challenges all take time away from value-adding activities for cash application teams. One way to deal with this? Use Billtrust’s Cash Application solution.

Accelerate cash application

Billtrust Cash Application finds remittance everywhere it lives, whether that be emails, websites, or your customers' AP portals. Billtrust has built-in integration with 200+ AP portal providers, so electronic remittance is captured and standardized automatically.

For paper checks, Billtrust Cash Application integrates with your bank’s lockbox to ingest remit data, and we can help convert your check payers to electronic payments with highly effective email and phone campaigns.

Central to Billtrust Cash Application is the Digital Lockbox. This is a single email inbox where your customers' digital payments are sent or re-routed. Inside the Digital Lockbox, emailed credit card payments are processed, and credit card remittances are automatically captured along with emailed ACH remittances.

Billtrust Cash Application features deep integrations with leading banks and ERPs. Machine learning adapts to how you use your ERP and to your buyers’ specific payment patterns. Our confidence-based matching engine delivers industry-leading match rates without human interaction.

Exceptions do occur and are easy to handle. On average Billtrust Cash Application resolves exceptions in half the time it takes other solutions.

Not all machine learning is the same

Billtrust Cash Application leverages machine learning differently than other solutions on the market. Our machine learning algorithms are more flexible and accurate, leading to industry-leading match rates and straight-through processing.

There are five key ways our machine learning capabilities are the best-in-class:

- Tailored to your firm. Your machine learning model is custom-built for your ERP and your unique invoicing structure.

- Accurate predictions. We train each custom model using Open Balance data, which increases predictability.

- Flexible matching. Our Machine Learning Engine is flexible and can use any field to match remits with invoices, such as BOL or PO number.

- Robust invoice number recognition. We can predict that a number on a remittance is the invoice number regardless of the format.

- Automatically improve over time. Our custom models improve over time based on how your staff handles exceptions in their day-to-day work. Our system sends a corrections file at the end of each day to compare what was initially extracted to what was applied and makes adjustments for future payments.

Improve your cash flow and accelerate digital payments with accounts receivable automation

Automating and implementing new finance processes come with challenges. But to grow and thrive as a business, there is no going back.

Accounts receivable automated solutions like Billtrust’s Business Payments Network (BPN) Invoicing and Cash Application work hand in hand to boost your cash application team’s productivity and accelerate payments. At the same time, they are streamlining the entire order-to-cash process.

At Billtrust, we're constantly innovating and expanding our solutions to give businesses the best possible AR automation experience.

Are you looking for more insights to accelerate payments and speed up your cash flow? Reach out to us or read more about Billtrust Cash Application. Contact us today to start accelerating payments.

Download the ultimate guide to digital accounts receivable